Blog home

WEEKLY MARKET UPDATE

MAR 07, 2024

An Early BTC ATH Switches Up Halving Trend, ETH Shows Mighty Market Resilience, and Memecoin Mania Returns

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic —this week we revisit the halving and its impact on crypto markets.

Crypto Movers

Crypto News

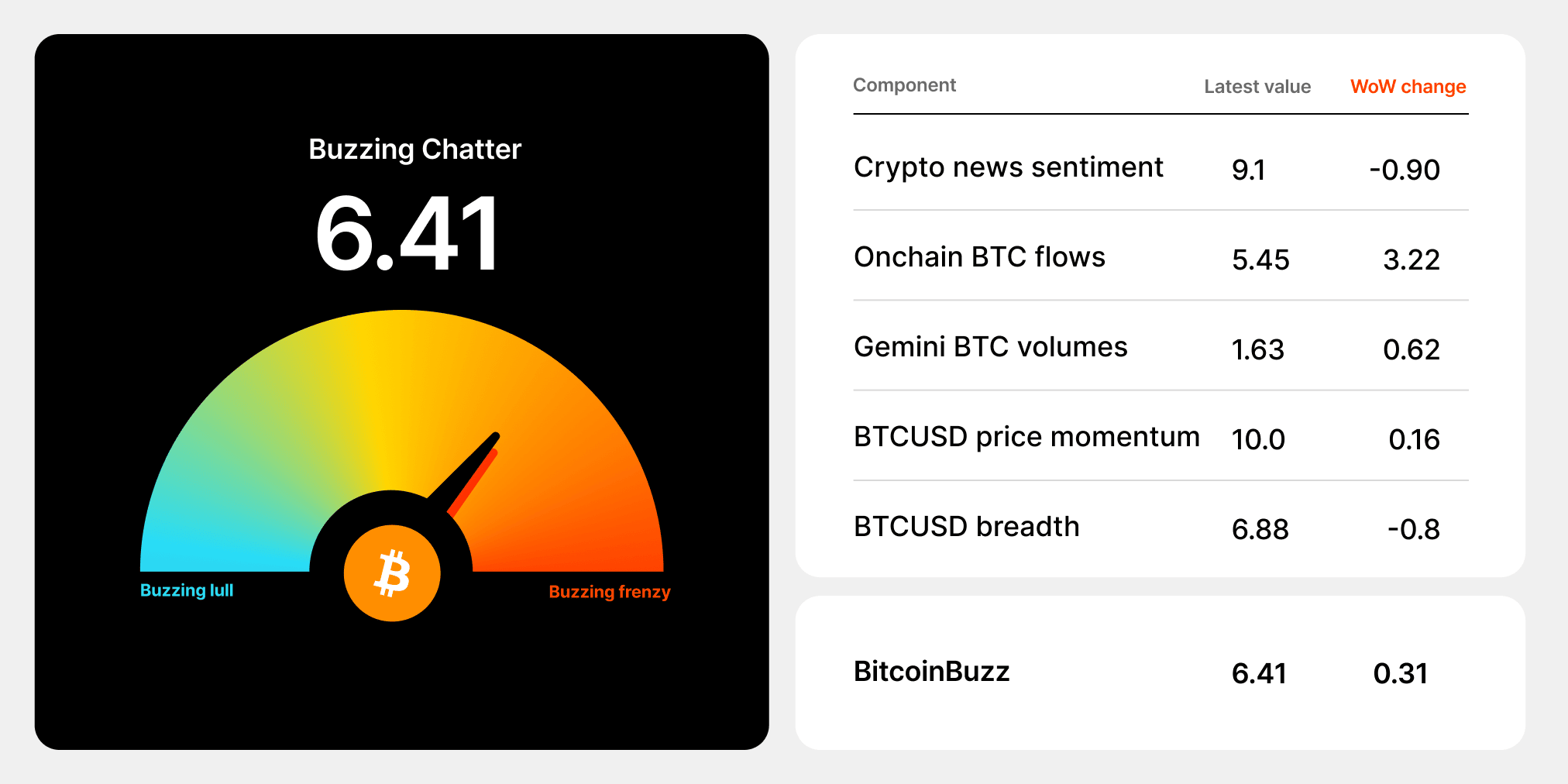

BitcoinBuzz Indicator

Topic of the Week

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, March 7, 2024, at 2:35pm ET. Check out the latest crypto prices here. All prices in USD.

Takeaways

- BTC ATH breaks historical four-year halving cycle trend: Bitcoin (BTC) broke above the $69,000 mark this week, setting a new all time high of $69,324 on Tuesday morning. Despite common consensus of a post-halving bull run in the cards, like others that occurred in past four-year cycles, the market appears to be responding positively to the upcoming BTC halving and moving earlier than anticipated.

- ETH holds firm despite sell off and ETH ETF delays: A sell-off following the BTC price run, as well as the SEC’s announcement to delay the decision deadlines on the spot Ethereum (ETH) ETF applications from Blackrock and Fidelity, had little impact on the price of ETH, with the market focusing on the anticipated launch of the network's Dencun upgrade, which is set to go live in the coming days.

- Michael Saylor's MicroStrategy is looking to raise $600M to buy more BTC: MicroStrategy (MSTR) has announced plans to raise $600M by selling convertible debt in a private offering, for the alleged purpose of acquiring more bitcoin, taking advantage of the recent price run, and adding to its 193,000 BTC stack.

- Memecoin mania is back: Momentum gathered for the six memecoins currently populating the top 100 list of cryptos by market cap, with multiple triple-digit percentage gains across the board, made up of DOGE, SHIB, PEPE, BONK, WIF, and FLOKI. Coinmarketcap data currently show the aggregate market cap of all memecoins standing at approximately $55B. The flurry of activity particularly across memecoins may suggest retail investors are beginning to return to the market or new retail participants are entering the market.

- US interest rate cuts on the horizon: Federal Reserve Chair Jerome Powell told House lawmakers on Wednesday that interest rate cuts are likely "at some point" in 2024, but not in the near future.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

BTC Soars To Reach a Record High

BTC hit a new all time high (ATH) this week after breaking above the $69,000 mark on Tuesday morning, setting a new high of $69,324. Before this week, the last time BTC set a record-setting price was November 2021. This marks the first occasion in which the price of BTC has set a new ATH before an upcoming BTC halving event. In previous cycles, new highs have been reached post-halving, which suggests a possible change in market conditions and a move away from the historical investment patterns related to the traditional four-year halving cycles.

The excitement of new highs was short-lived however, as many market participants took profit, including one miner who cashed significant holdings including some bitcoin that he held as early as 2010. Prices tumbled further later in the day, as a cascade of liquidations that totaled $1.1B over a 24-hour period sent the price of Bitcoin below $60k, according to Coinglass data. Given the steep run-up in prices over the past few weeks and skyrocketing derivative funding costs with open interest growing, the sharp correction wasn't a huge surprise and can be seen as a healthy recalibration of the market, allowing for more sustainable price appreciation going forward.

Funding rates have since come down significantly, and the price of BTC has returned to the $66k level. The decrease in annualized funding rates to below 20% from previous triple-digit figures suggests a market reset, potentially opening the door for a more stable and long-lasting move to more record highs. Meanwhile flows into the BTC ETFs continue to show strong demand, with over $1B of inflows since the start of the week.

ETH Shows Mighty Resilience Following Market Sell-Off

The price of ETH has shown huge resilience following the recent sell-off across the crypto market. Despite briefly dropping from $3.8K to $3.2K in just a few hours on Tuesday, the price has since rallied and surpassed its recent high to touch $3.8K by Wednesday morning.

ETH has been experiencing positive momentum recently, in part, due to the potential approval of the first spot ETH ETF anticipated to launch later this year. However, the Securities and Exchange Commission (SEC) announced on Monday that it would be delaying any decision on the applications from Blackrock and Fidelity. This was widely expected and resulted in little impact on the price of ETH, with the market more focused on the anticipated launch of the network's Dencun upgrade which is set to go live on Mainnet on March 13th. The upgrade aims to address issues around scalability by introducing proto-danksharding in an attempt to increase transaction processing speeds and make transactions more cost effective.

One of the Largest Accumulators of BTC Is Filling Their Bags

MicroStrategy (MSTR), a company that provides business intelligence, mobile software, and cloud-based services, which is helmed by founder Chairman Michael Saylor, announced on Tuesday that it plans on raising $600M by selling convertible debt in a private offering.

The company plans to use the proceeds of the raise to acquire more BTC and for general corporate purposes. Microstrategy has been one of the largest accumulators of BTC in recent years and currency holds 193K BTC.

Memecoin Mania Returns

Memecoin mania returned this week in what appeared to be a precursor for the inevitable broadening of crypto market participants. Six memecoins currently populate the top 100 list of cryptos by market cap, with multiple triple-digit percentage gains across the board, DOGE, SHIB, PEPE, BONK, WIF and FLOKI.

Coinmarketcap data currently show the market cap of all memecoins standing at around $55B. The flurry of activity across memecoins may suggest retail investors are beginning to return to the markets, with a potential rotation into other sectors of the market possible following the large returns of the last week.

Interest Rate Cuts Likely at Some Point This Year

Federal Reserve Chair Jerome Powell told House lawmakers on Wednesday that interest rate cuts are likely "at some point" in 2024, noting however that policymakers remain attentive to the risks that inflation poses and don’t want to ease up too quickly and risk stable economic growth.

Powell prepared remarks for appearances on Capitol Hill, with stocks posting gains as he spoke, and the Dow Jones Industrial Average up more than 250 points heading into midday. Treasury yields moved lower as the benchmark 10-year note was off about 0.3 percentage point to 4.11%.

-From the Gemini Trading Desk

BitcoinBuzz data as of 4:13pm ET on March 6, 2024.

To learn more about the BitcoinBuzz Indicator and its components, read our introduction here. Check back every week for an updated score!

What Will the 4th Bitcoin Halving Mean for Bitcoin and Crypto?

Bitcoin halving events occur roughly once every four years. Thus far, in the network's almost 15-year history, the price of bitcoin (BTC) has increased significantly in the period following each halving event. With the fourth Bitcoin halving expected to arrive in April 2024, here, we explore what a halving is and what it could mean for the price of bitcoin and crypto.

Why Is It Important?

The supply schedule of bitcoin is deflationary with a finite supply of 21 million bitcoin. This feature differentiates it from all fiat currencies and many other cryptos. Bitcoin’s supply schedule dictates that every time a miner successfully writes a new block to the blockchain (i.e., solves the proof of work puzzle), that miner receives a set number of bitcoin called the "block reward."

If this block reward never changed, the supply of bitcoin would increase forever. To encode Bitcoin’s deflationary nature, every 210,000 blocks — roughly every four years — the block reward is reduced by half, an event often referred to as the “the halving” or "the halvening."

Genesis: When Bitcoin launched in 2009, the initial block reward was 50 bitcoin. First Halving: On November 25, 2012, the first halving occurred, halving the block reward from 50 to 25 bitcoin. Second Halving: On July 10, 2016, the second halving occurred, halving the block reward from 25 to 12.5 bitcoin. Third Halving: On May 11, 2020, the third halving occurred, halving the block reward from 12.5 to 6.25 bitcoin. Fourth Halving: The next halving is expected to happen in April 2024 and will reduce the block reward from 6.25 to 3.125 bitcoin.

The block reward will continue to undergo halvings until it reaches 0, which is estimated to happen sometime in the year 2140. At that point in time, there will be a total of 21 million bitcoin in circulation.

This reduction in the supply of bitcoin, about every four years, has played a significant role in price swings following a halving event. Could we see a similar dynamic this time around?

How Have Previous Halvings Impacted the Price of Bitcoin?

The halving certainly isn’t the only factor that can impact the price of bitcoin. Just this year we’ve seen the impact national monetary policy and other developments like the emergence of a spot bitcoin ETF can have on prices. Nevertheless, the halving is a notable event for investors and forms one of the main pillars in bitcoin’s investment case.

The price of bitcoin saw a parabolic rise in the periods following each of its three previous halving events. Will we see a similar increase in price following the fourth Bitcoin halving coming in a few months? Nothing is certain, but if history is any guide we could be in for a wild ride.

Read more here.

See you next week. Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

APR 25, 2024

BTC Halving Brings Market Optimism and Record Mining Rewards, Crypto Lobbyists Sue SEC

WEEKLY MARKET UPDATE

APR 18, 2024

BTC Takes a Hit, Spot BTC ETFs Launch in Asia, and Geopolitical Tensions Heat Up

NEWS

APR 18, 2024