Blog home

WEEKLY MARKET UPDATE

MAR 01, 2024

BTC Breaks $60K, Ushering In Crypto Bull Market, With No Signs of ETH Slowing Down, UNI Soars Over Governance Proposal, AR Trades +75% on Testnet Release News

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we discuss the convergence of artificial intelligence (AI) and crypto.

Crypto Movers

Crypto News

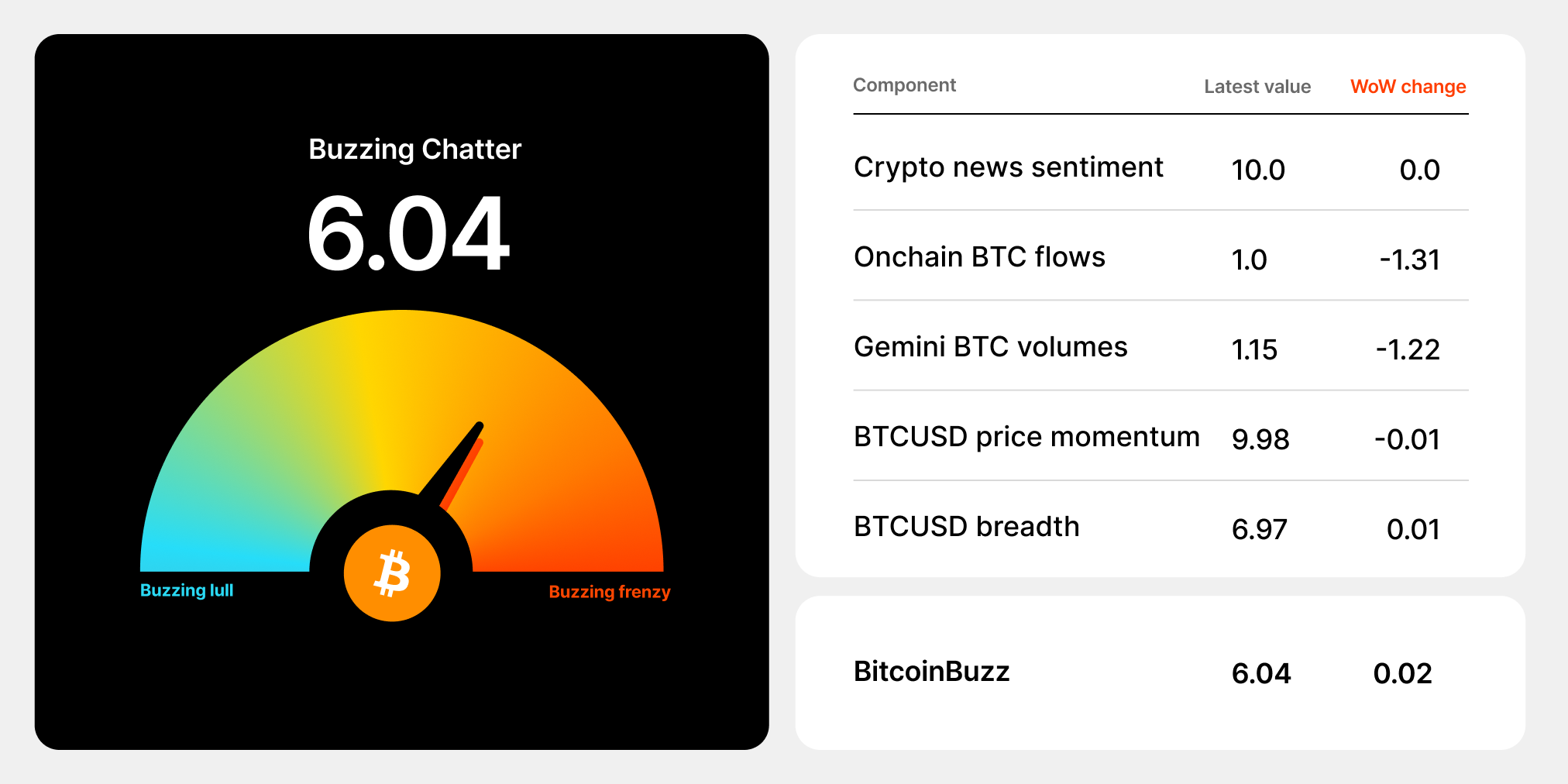

BitcoinBuzz Indicator

Topic of the Week

*Percentages reflect trends over the past seven days.

**Crypto prices as of Friday, March 1, 2024, at 7:00am ET. Check out the latest crypto prices here. All prices in USD.

Takeaways

- BTC Surges to 2-Year High: The price of bitcoin (BTC) has soared past $60,000 after weeks of consolidation, setting the stage for a potential challenge of its record high of $69,000, driven by institutional demand, anticipation of the upcoming halving, and other catalysts, with MicroStrategy adding 3,000 BTC to its holdings.

- ETH Surges, Outperforms BTC Amid ETF Launch Optimism: The price of Ether (ETH) continues upward, outpacing BTC as it approached 0.06 on the ETHBTC pair but ultimately faced resistance. It remains elevated at around $3,350, amidst anticipation of a potential approval for a spot ETH ETF.

- UNI Price Soars on Governance Reform Proposal: Uniswap's (UNI) value surged dramatically after the Uniswap Foundation released a proposal for overhauling its governance system, with UNI token holders potentially receiving rewards, leading to a remarkable price increase of over 50% in a day, hitting $12.86, its highest point in more than two years.

- AR Gains +75% On Testnet News: On Tuesday, Arweave (AR) announced the release of the public testnet for Arweave AO. According to the Arweave team, this will be a scalable blockchain network, built upon the foundation of its existing data storage platform, promising substantial scalability enhancements compared to other blockchains. AR has emerged as one of the standout performers in the past seven days, trading up +75%.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

BTC Rally: Price hits 2-Year High Ahead of Bitcoin Halving

After consolidating in a tight range between $51k-$53k over the past two weeks, the price of Bitcoin has surged since Monday, briefly touching $64,000 for the first time since November 2021.

This significant uptrend is positioning Bitcoin for a potential run at its all-time high of $69,000 achieved in November 2021, potentially occurring much sooner than initially expected by many market participants. The surge in price has been fueled by several catalysts, including strong institutional demand, anticipation surrounding the upcoming BTC halving, and expected interest rate cuts later this year.

Notably, the demand for spot Bitcoin exchange-traded funds (ETFs) has demonstrated impressive growth, with inflows nearing $2 billion in the past four days alone, while outflows from Grayscale Bitcoin Trust (GBTC) have slowed considerably.

Microstrategy reaffirmed its confidence in the digital asset by adding another 3,000 BTC to its holdings, bringing its total Bitcoin holdings to 193,000 BTC. The upcoming Bitcoin halving, which is expected to take place around April 20th, will reduce Bitcoin issuance by half and could potentially add further pressure on the supply side.

ETH Price Surges, Outpacing Bitcoin Amidst ETF Launch and Regulatory Speculation

During the early part of the week, Ethereum’s price continued its trend of outpacing Bitcoin, showing significant strength as it surged towards 0.06 on the ETHBTC pair for the first time since the introduction of the Bitcoin spot ETFs in January. However, as experienced previously, the pair encountered strong resistance at the 0.06 level, leading to a rapid rejection and subsequent decline to the 0.056 level by Wednesday, coinciding with Bitcoin's climb above $59,000.

Despite this, Etheruem’s price is at its highest level since March 2022, currently trading at around $3,350 at the time of writing. Confidence in the market continues to grow with a possible regulatory approval of a spot ETH ETF in the near future.

UNI Price Skyrockets on Governance Reform Proposal

On Friday, Uniswap (UNI), the largest decentralized exchange by market capitalization, saw a significant spike in price following the release of a proposal by the Uniswap Foundation detailing an overhaul of the project's existing governance system. As outlined in the proposal, UNI token holders who have staked or delegated their tokens would be entitled to receive rewards.

The market responded to this news with an overwhelmingly positive reaction, propelling the price of UNI by over 50% in a single day and reaching a peak of $12.86, marking its highest value in over two years.

AR Launches Public Testnet for Arweave AO, Promising Scalability and Data Storage Advancements

On Tuesday, Arweave (AR) announced the release of the public testnet for Arweave AO. According to the Arweave team, this will be a scalable blockchain network, built upon the foundation of its existing data storage platform, promising substantial scalability enhancements compared to other blockchains.

By doing so, Arweave AO will be able to support the storage of vast quantities of data, including AI models, positioning it with a competitive advantage over alternative blockchains.

AR has emerged as one of the standout performers in the past seven days, trading up +75%.

-From the Gemini Trading Desk

BitcoinBuzz data as of 6:18pm ET on February 28, 2024.

To learn more about the BitcoinBuzz Indicator and its components, read our introduction here. Check back every week for an updated score!

What Is a Bull Market?

In financial markets, a “bull” or a “bear” market occurs when asset prices trend in a particular direction over an extended period of time. If a market trends upwards and assets grow in value, it’s referred to as a “bull market.” When a market trends downwards and asset values are declining, it’s known as a “bear.”

The terms bull market and bear market have been used throughout financial markets for centuries, and the emerging crypto space has also embraced them. With the rapid market cycles and dynamic price movement evinced in crypto thus far, both bulls and bears have plenty to keep them busy.

What’s the Difference Between a Bull and a Bear Market?

From both a short-term (hourly, daily) and long-term (monthly, annual) perspective, markets operate in a cyclical fashion through upwards and downwards movements as the price of an asset is determined. An easy way to distinguish a bull versus bear market is to think of them as “up” vs. “down,” or “peak” vs. “trough.”

Investment Considerations for Bull and Bear Markets

Although the general nature of a bull or a bear market is distinguished primarily by the direction of asset prices, there are other characteristics that are important to consider. A bull market or bear market framework represents parameters for understanding market sentiment, but that sentiment is contingent upon a number of co-existing factors. For example:

To determine whether the market is bull or bear, it’s important to look at not just the market's immediate reaction to particular conditions, but how it's performing in wider contexts. Small movements might represent a market correction — a short-lived trend that usually lasts less than a few months. However, bull and bear markets are not ephemeral trends; rather, they’re longer term, macro phenomena. For example, if an asset increases 200% in three months, and then drops 20% in the next month, then the criteria for a long-term bearish downtrend has likely not yet been met, even though downward momentum is prevalent.

In a bull market, there tends to be strong demand for assets, but weak supply. As a result, prices will rise. In a bear market, more people are looking to sell assets than to buy. The demand is significantly lower than the supply. As a result, prices drop. However, as the supply and demand ebb further in one direction, the more probable an eventual turnaround becomes. For example: As prices of an asset go up, so can selling pressure from investors taking profits, which increases the supply.

Investor sentiment and market performance are interdependent. In a bull market, investors flock to buy and sell assets with the hope of gaining a profit. During a bear market, the mood is negative and investors don’t tend to expect upward momentum until the bear trend has definitively ended.

Any asset’s market is intrinsically linked to the wider economy in which it is situated. For example: A bearish stock market is typically associated with a weak economy. A weak economy can lead to decreased consumer spending, which generally means lower profits for businesses, which in turn can decrease overall risk appetite for speculative investments. In a bull market, people have more money to spend and are willing to spend it, which has the effect of strengthening the economy.

The terms “bull” and “bear” are applicable mostly with regard to extended time frames. Small movements are generally just a correction. A correction is not the same as a bear market. Moreover, markets often stagnate and remain steady before they validate a particular trend direction. In such an interim, the string of small upward and downward movements cancels out any gains or losses, resulting in a flat market trend that can continue for periods that are even longer than the bull or bear markets themselves. Because prices are trending lower in a bear market, you might make some purchases that could prove beneficial in the long run. The issue with investing in a bear market, however, is that you don't know how long the dip will last or how far the prices will drop. Hence, you could risk making a premature buy, or might miss the opportunity to make a good investment altogether. Because any investment you make could be speculative, patience is paramount.

Read more here for additional information on bull and bear markets and how they can play into an investment strategy.

See you next week. Onward and Upward! Team Gemini

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

APR 25, 2024

BTC Halving Brings Market Optimism and Record Mining Rewards, Crypto Lobbyists Sue SEC

WEEKLY MARKET UPDATE

APR 18, 2024

BTC Takes a Hit, Spot BTC ETFs Launch in Asia, and Geopolitical Tensions Heat Up

NEWS

APR 18, 2024