Blog home

WEEKLY MARKET UPDATE

APR 18, 2024

BTC Takes a Hit, Spot BTC ETFs Launch in Asia, and Geopolitical Tensions Heat Up

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic —this week we revisit the halving and its impact on crypto markets.

Crypto Movers

Crypto News

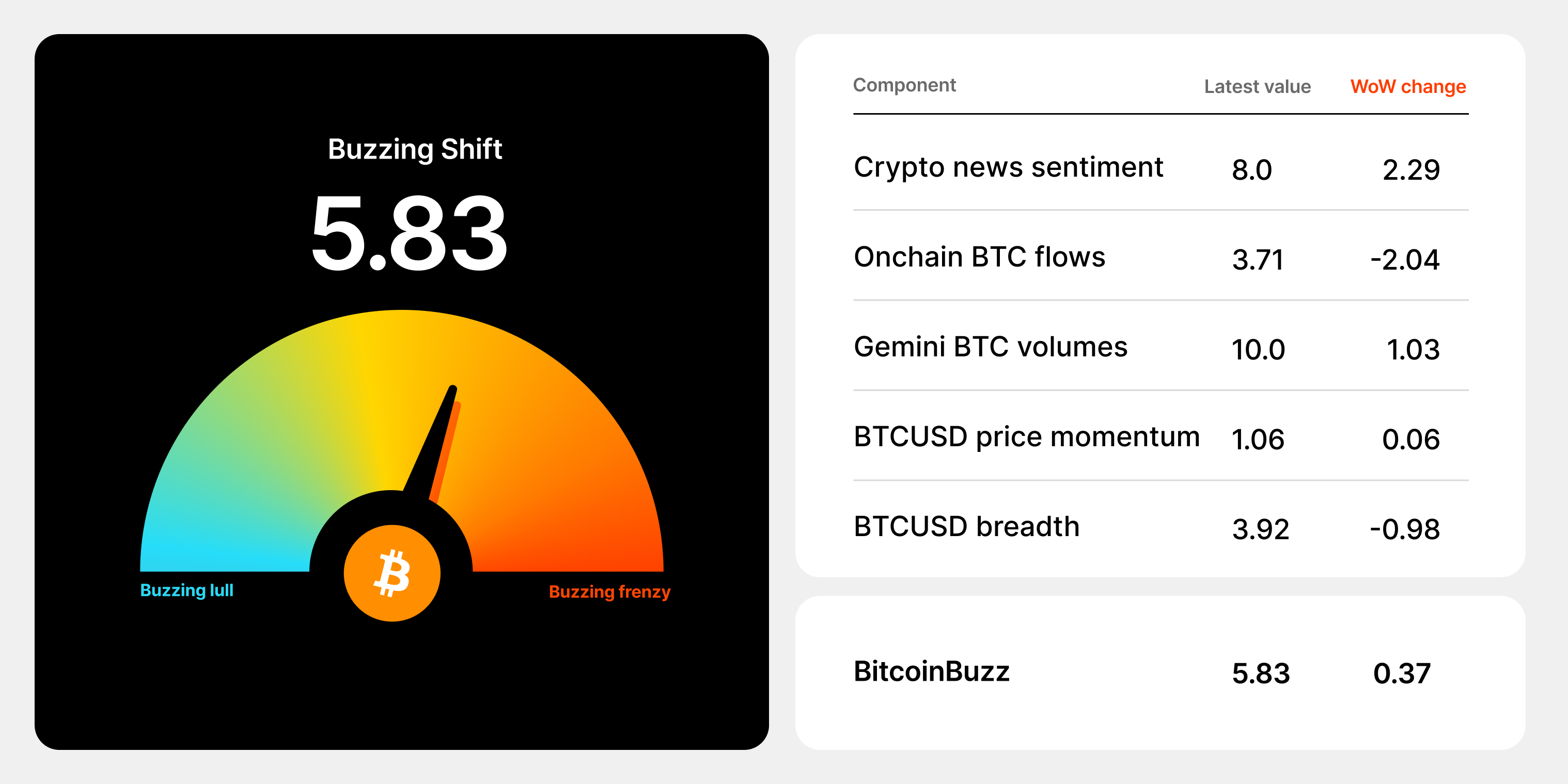

BitcoinBuzz Indicator

Topic of the Week

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, April 18, 2024, at 5:00pm ET. Check out the latest crypto prices here. All prices in USD.

Takeaways

-

Iran’s weekend attack on Israel prompts crypto selloff: Iran fired more than 300 missiles and drones at Israel over the weekend, heightening market fears that a wider conflict in the Middle East could break out. Crypto markets reacted initially with the price of BTC dropping from $67,800 to $61,300.

-

Fed chair sounds hawkish on rate cuts: Federal Reserve chairman Jerome Powell on Tuesday cast doubt on carrying out previously expected interest rate cuts later in 2024. The price of BTC dipped the following day, briefly dropping below $60K, before mounting a small rally.

-

Hong Kong approves first Bitcoin and Ethereum spot ETFs: The move could help further establish Hong Kong as a key Asian hub for cryptocurrency trading. Markets are now watching closely to see if they receive more interest than Hong Kong’s previously launched BTC and ETH futures ETFs.

-

ETH price falls to three-year low against BTC: ETH’s value against BTC has reached a three-year low, despite recent ETH spot ETF approvals and post-Merge price increases, with high transaction fees posing ongoing challenges.

-

US Senators move to advance stablecoin regulation: US Senators Cynthia Lummis and Kirsten Gillibrand introduced a bipartisan bill on Wednesday to regulate stablecoins that would require issuers to obtain federal licenses and maintain full reserves as a way to safely integrate them into the US financial system alongside the dollar.

-

Solana-based DEX ‘Drift’ set to airdrop 10% of its token supply: The 100 million DRIFT token airdrop has been stirring excitement about the platform’s potential growth in the coming months.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Conflict in the Middle East Triggers Crypto Selloff Over the Weekend, Markets on Edge as Israel Plans Iran Response

Iran launched a planned drone and missile attack at Israel late Saturday in response to Israel’s strike against Hamas and Islamic Revolutionary Guard Corps in Syria two weeks prior. While the attack was known by the global intelligence community, it sparked fears of a wide-scale conflict in the Middle East. While traditional markets were closed as the attack occurred over the weekend, crypto markets reacted immediately with BTC selling off from $67,800 to $61,300.

Other majors such as ETH and Solana (SOL) also saw rapid declines, and the more speculative altcoins and memecoins selloffs were even more acute. Leverage within the crypto ecosystem had been high, and the weekend move saw $1.5 billion in long liquidations on Friday and Saturday, according to Coinglass.

Crypto markets have found some footing after BTC dipped briefly below $60K on Wednesday. However, altcoins still bore the brunt of the selloff. SOL and Ripple (XRP) have both dropped by more than 20% from Tuesday to the week prior.

In traditional markets, Israel’s ongoing conflict with Iran has triggered fluctuations as well, with investors closely monitoring any developments that could impact market stability and sentiment. This situation has caused an increase in risk aversion, leading to shifts in asset allocations, as traders and investors seek safer investment havens amid the uncertainty.

Powell Sounds Hawkish Tone on 2024 Rate Cuts

The price of BTC dropped below $60K on Wednesday morning, a day after Federal Reserve chair Jerome Powell questioned whether he would be able to carry out expected interest rate cuts in 2024. The news comes after CPI inflation data checked in at 3.5% last month, above the expected 3.2% mark.

Powell has kept the benchmark interest rate at 5.25-5.5% since last July. It appears he won’t cut rates until the US makes more progress toward the Federal Reserve’s 2% inflation goal.

“We can maintain the current level of restriction for as long as needed,” Powell said.

Powell acknowledged that the Fed’s restrictive policy has helped fight inflation that peaked at 9.1% in June 2022, but Powell said it still isn’t dropping quickly enough.

“More recent data shows solid growth and continued strength in the labor market, but also a lack of further progress so far this year on returning to our 2% inflation goal,” he said.

Hong Kong Embraces First Spot BTC and ETH ETFs

Hong Kong regulators have approved the first BTC and ETH exchange-traded funds (ETFs), helping position Hong Kong as a competitive financial hub in Asia for cryptocurrency trading. The introduction of these ETFs is expected to attract both institutional and retail investors, providing them a regulated and potentially less volatile means of investing.

However, some have pointed out that their success seems less certain than US-based spot ETFs. When Hong Kong-based BTC and ETH futures ETFs were launched in 2022, they received less interest than their US counterparts by a substantial margin.

ETH Reaches 3-Year Low Against BTC

The price of ETH has plummeted to a three-year low against BTC, despite the approval of the first ETH spot ETFs in Hong Kong this week. Since the protocol’s transition to proof-of-stake in 2022, the ETH/BTC pair has dropped by roughly 33%, dropping close to 10% in the past month alone.

However, the price of ETH itself has more than doubled since The Merge occurred. Some analysts have projected that ETH could be in store for a rally in the coming months due to the recent optimism around BTC. Others have said BTC might make for a more appealing asset in the eyes of investors until ETH can address its high fees.

US Senators Seek to Further Stablecoin Regulation With New Bill

US Senators Cynthia Lummis and Kirsten Gillibrand introduced new legislation Wednesday aimed at regulating stablecoins. Their bipartisan bill seeks to establish clear guidelines for stablecoin issuers, including a requirement for them to obtain appropriate federal licenses and maintain full reserves. The proposed law also addresses consumer protection and systemic risk, and notably includes a ban on algorithmic stablecoins–the kind of stablecoin used by the Terra ecosystem which infamously collapsed in 2022. Gillibrand said that the legislation would be essential in enabling stablecoins to coexist with the US dollar.

Solana-Based ‘Drift’ Set For 100 Million Token Airdrop

Decentralized exchange Drift, based on the Solana network, is set to airdrop 100 million DRIFT tokens to users. The airdrop will constitute 10% of the token’s 1B supply, and will be allocated based on users’ activity on the platform. Despite the airdrop whipping up excitement in the Solana community, the DEX is not a particularly new project; it was launched in 2021 as one of the earliest DeFi projects on the platform. DEX tokens previously launched, notably Uniswap’s UNI and PancakeSwap’s CAKE, were successful.

-From the Gemini Trading Desk

BitcoinBuzz data as of 5:14pm ET on April 18, 2024.

To learn more about the BitcoinBuzz Indicator and its components, read our introduction here. Check back every week for an updated score!

Unpacking the Arguments over Upcoming Bitcoin Halving Event

The Olympics. The World Cup. The US presidential election.

A Bitcoin halving event.

Each draws the world’s attention every four years. Each generates intense debate.

While a BTC halving event might bring in a slightly smaller contingent than a US presidential election or the Olympics, it’s still a momentous occasion. The debate over how the latest halving will impact the price of BTC has raged on for months.

Some analysts have speculated the halving could send the price of BTC skyrocketing. Others have argued the halving was priced in during BTC’s surge in price over the past year-plus. With the halving looming, let’s review what it entails and take a closer look at the debate.

The BTC halving is set for Friday or Saturday.

Read more about how it will impact BTC here:

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

WEEKLY MARKET UPDATE

MAY 02, 2024

Crypto Market Slides, Then Rallies After Federal Reserve Holds Steady

DERIVATIVES

MAY 02, 2024

Introducing Seamless SGD to GUSD Transfers on Gemini’s Derivatives Platform

DERIVATIVES

MAY 01, 2024