Contents

Chainlink 2.0: Advanced Decentralized Oracle Networks

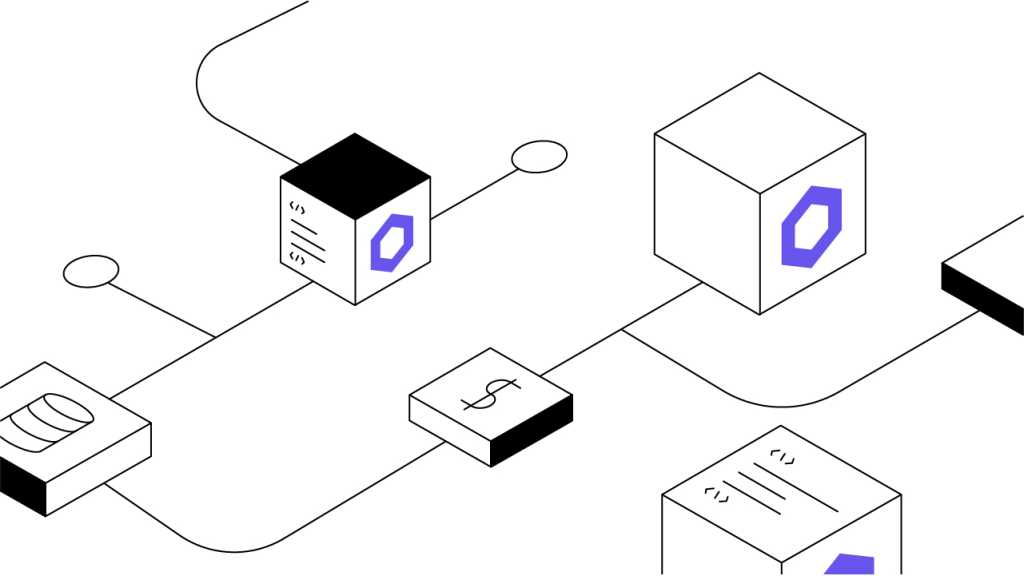

Chainlink’s latest upgrade lays out the roadmap for expanding the functionalities of Chainlink smart contracts and connecting them to off-chain data.

Summary

Since its inception, Chainlink has been concerned with expanding the capabilities of smart contracts by developing ways to integrate them with external data, with the end goal of broadening the use cases of smart contracts in the real world. Announced in 2021, Chainlink 2.0 focuses on expanding the organization’s initial product offerings by implementing a collection of decentralized oracle networks (DONs) to provide off-chain computation that might improve the efficiency, cost-effectiveness, and applicability of Chainlink smart contracts. Chainlink 2.0 invokes the concept of hybrid smart contracts, which are designed to help blockchain-based products and services reap the benefits of both on-chain and off-chain environments, all the while streamlining how smart contracts can be developed and deployed for increasingly diverse and complex use cases — potentially ushering in the next generation of smart contracts.

Introduction to Chainlink 2.0

is a that seeks to provide a high degree of efficiency, reliability, and security for blockchain-based platforms and that feed their with external, data. Part of the reason that smart contracts are praised for being so performant, automated, and tamper-resistant is that they typically execute in a purely on-chain environment. Increasingly, though, complex smart contract applications have invoked the need for external data. are the means by which smart contractors can query, verify, and authenticate external data and then relay it to a smart contract on a blockchain. Most smart contracts are only as good and as accurate as the data that feeds them, so the historical challenge has become ensuring the quality of external data while preserving trust, privacy, and security — a dilemma dubbed “the oracle problem.”

Since its launch in 2017, Chainlink has taken great strides in tackling the oracle problem, and has become one of the most relied upon projects in the blockchain ecosystem in the process. Some experts even argue that Chainlink oracles have become the de facto industry standard, thanks in part to Chainlink’s first-mover status and rapidly growing development that strives to keep the organization's technology on par with ever-evolving smart contract use cases. As of July 2021, Chainlink reported over 600 with applications ranging from applications to gaming, data provision, insurance, real estate, and much more. Chainlink is the most widely used decentralized oracle network, and is the choice of many of the most reputable projects in the blockchain industry. Similarly, hundreds of data providers have integrated and monetized their data via Chainlink’s platform.

By relying on Chainlink as a type of middleware, the organization aims to improve how smart contracts request and implement highly valuable data from outside sources, or oracles, while helping to maximize the accuracy and reliability of such outside (i.e., off-chain) data. Ultimately, the vision of such enhancements is to empower smart contracts to achieve a greater quality and quantity of functionalities across a wide variety of industries.

Chainlink 2.0 — announced in an April 2021 — outlines a long-term, multi-year for the continued development of Chainlink’s decentralized oracle networks and the enhancement of the platform’s ability to further facilitate the rapid expansion of smart contract use cases. The Chainlink 2.0 roadmap includes a variety of technical advancements that promote increased functionality for Chainlink smart contract applications. The crux of these advancements is a network of DONs that come together to form an off-chain computational layer capable of coordinating .

DONs in the Chainlink Oracle Ecosystem

Chainlink has already established itself as an effective decentralized oracle network over the last several years, with decentralized services including:

Price Feeds: Providing on-chain financial market data for a wide variety of assets, primarily used by DeFi applications. Chainlink has been called the “backbone of DeFi” for its role in providing highly accurate decentralized price data.

Verifiable Random Functions (VRF): Providing cryptographically verifiable randomness and provable rareness for all kinds of applications, from to minting .

Proof of Reserve: Providing on-chain data feeds which allow smart contracts to conduct on-demand audits of tokenized assets such as .

External Adaptors: Providing the development tools for smart contract developers to connect to most off-chain data providers or .

Now, Chainlink seeks to generalize its oracle network into a multiplicity of DONs in order to accommodate a suite of even more decentralized services for smart contracts built on any blockchain environment. Chainlink contends that DONs are uniquely capable of offering advantages that blockchains alone cannot by facilitating hybrid smart contracts which combine the best parts of both the on-chain and off-chain ecosystems.

By relying on blockchain technology for security, while simultaneously reaping the high degree of connectivity, functionality, and scalability that many off-chain systems offer, Chainlink seeks to enhance the architecture of DONs to support a broader range of users and use cases for smart contracts. DONs essentially serve as the coordinating mechanism and backbone for hybrid smart contracts that utilize existing on-chain code and combine it with highly valuable, highly versatile off-chain computations.

Updated Chainlink Smart Contracts: On- and Off-Chain Hybrids

Hybrid smart contracts represent Chainlink’s model for composing both on-chain and off-chain resources into augmented smart contracts with increased versatility, , confidentiality, and functionality. In terms of scalability and confidentiality, Chainlink DONs are designed to compute oracle-provided data in an off-chain environment for increased and decreased , while helping to maintain secure connections between on-chain and off-chain environments and supporting the confidential computation of smart contracts and oracle data.

In the vision of Chainlink 2.0, DONs and hybrid smart contracts go hand-in-hand, with hybrid smart contracts being able to integrate with off-chain resources and still retain the privacy and security of the base blockchain. Essentially, hybrid smart contracts entail offloading a portion of a smart contract’s computational load onto an oracle network for off-chain computation.

The Chainlink Node “Metalayer” and Off-Chain Computation

Whereas Chainlink’s 1.0 iteration introduced the concept of decentralized oracle networks, Chainlink 2.0 has its sights set on a framework for a collection of interoperating DONs, each with its own set of , variable , and the ability to perform more secure, confidential, and scalable off-chain computations that are geared to enhance smart contract infrastructure. Given a variety of interoperable DONs to choose from, individual users could then choose DONs that best fit their requirements.

DON architecture is envisioned not unlike , which connects to a parent blockchain to process data tangentially (and thereby more efficiently than when relying solely on the parent blockchain), only syncing back up with the intermittently. Similarly, Chainlink DONs are to be anchored to in order to perform off-chain computation and sync data outputs and state changes as necessary — of course with additional elements to help with enforcing correct reporting and settle off-chain disputes.

As of mid-2021, this architecture is still a work in progress. But essentially, this “metalayer,” as it has been described, is intended to be a network of DONs that will provide more off-chain computing resources to the Chainlink ecosystem. Ultimately, compared to Chainlink 1.0’s architecture, the 2.0 metalayer is slated to increase throughput and decrease costs, resulting in higher-frequency updates for decentralized services like price feeds, and more cost-efficiency for the development of all-new decentralized services.

With increasing demand for advanced smart contracts, Chainlink seems to think that traditional blockchains are unable to sufficiently satisfy those needs due to limitations in their native security models. So with a metalayer of DONs able to compute data instead of just storing it, Chainlink wants users to be able to make decisions regarding the of their smart contracts and mix and match individual components.

Which smart contract elements should take place on-chain, and which parts can be handled cheaper and faster off-chain using DONs? The answer will largely depend on the particular needs and requirements of each implementation. If security and transparency are the most important considerations, then it’s likely that most of the smart contract’s computation will still take place on-chain. If speed and affordability are more important, then perhaps more of the computation can be handled off-chain.

Chainlink Staking and Security

In order to help safeguard Chainlink’s growing network of DONs, a new security design has been introduced in the Chainlink 2.0 roadmap and includes a that intends to make it prohibitively expensive to manipulate a Chainlink node into providing false data.

The updated Chainlink staking concept is referred to as “super-linear staking” and is designed in such a way that compromising Chainlink’s network security would require an immense amount of resources — in theory, quadratically more resources than the combined security deposits of all DON nodes. In other words, this Chainlink staking implementation might be able to make the network exponentially more secure than .

Although this Chainlink staking mechanism has only yet reached the preliminary design stages (as of late 2021), the potential of having drastic, exponential security measures in place would provide incredible value when the quality and reliability of oracle-provided data is paramount to the optimal performance of Chainlink-powered smart contracts.

Realizing Chainlink 2.0

The grand vision of Chainlink 2.0 would have the already well-established platform grow into a pillar of the entire blockchain ecosystem. Some of the same decentralized services that Chainlink has historically provided — like and price data feeds for DeFi — are slated for enhancements via the integration of DONs that are designed to provide enhanced security, throughput, and cost-efficiency. Alongside those existing functions, all-new decentralized services are imagined and outlined by the Chainlink 2.0 roadmap. These include fair sequencing services (FSS), decentralized identity services, and more.

Although some of these features are still largely in development, or in early testing phases, the Chainlink 2.0 update is well underway. With incremental implementation and parallel development, Chainlink is likely to gradually shift closer toward its 2.0 form, starting in 2021 and extending for several years. If the project continues on its current trajectory, it stands to continue advancing the development of smart contract use cases that expand the overall blockchain ecosystem’s breadth and depth of real-world applicability. Simplifying how smart contracts communicate securely with external data is a crucial element of the continued expansion of blockchain and smart contract technology into the world of mainstream use.

Author

Is this article helpful?