Contents

What Is Compound in 5 Minutes

Compound is a decentralized, blockchain-based protocol that allows you to lend and borrow crypto — and have a say in its governance with its native COMP token.

By

Updated March 20, 2025 • 5 min read

Summary

The main backbone of today’s DeFi movement is Ethereum, a decentralized blockchain that enables smart contracts upon which other decentralized blockchain-based applications (dApps) with native cryptocurrencies can be built. Compound is one such protocol, primarily concerned with the financial services of borrowing and lending your crypto.

The Compound DeFi Protocol

First, let’s take a minute to talk briefly about so we can get some context as to where the Compound protocol fits into the broader crypto ecosystem.

Unlock the future of money on Gemini

Start your crypto journey in minutes on the trusted crypto-native finance platform

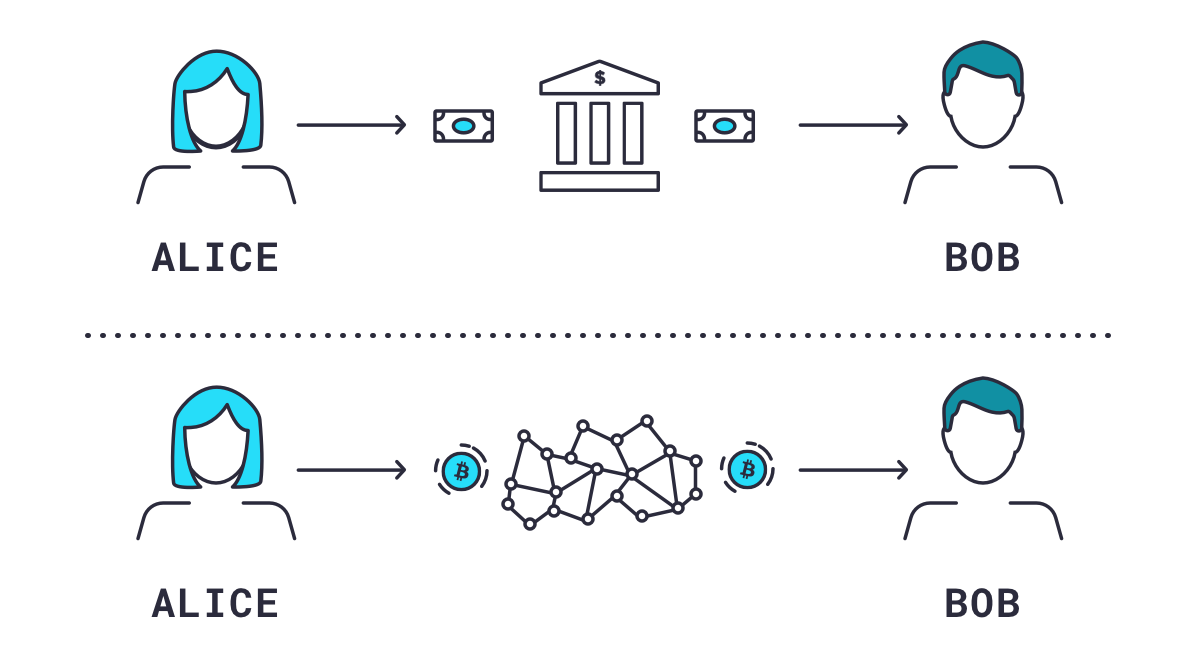

Cryptocurrencies are known for acting as decentralized money with respect to payments. Bitcoin (while many now consider it to be more a store of value similar to gold) is still of course the first and best example. Alice can pay Bob in bitcoin without going through a bank or other financial services intermediary, instead going through the , a decentralized network of independent nodes to validate the transaction.

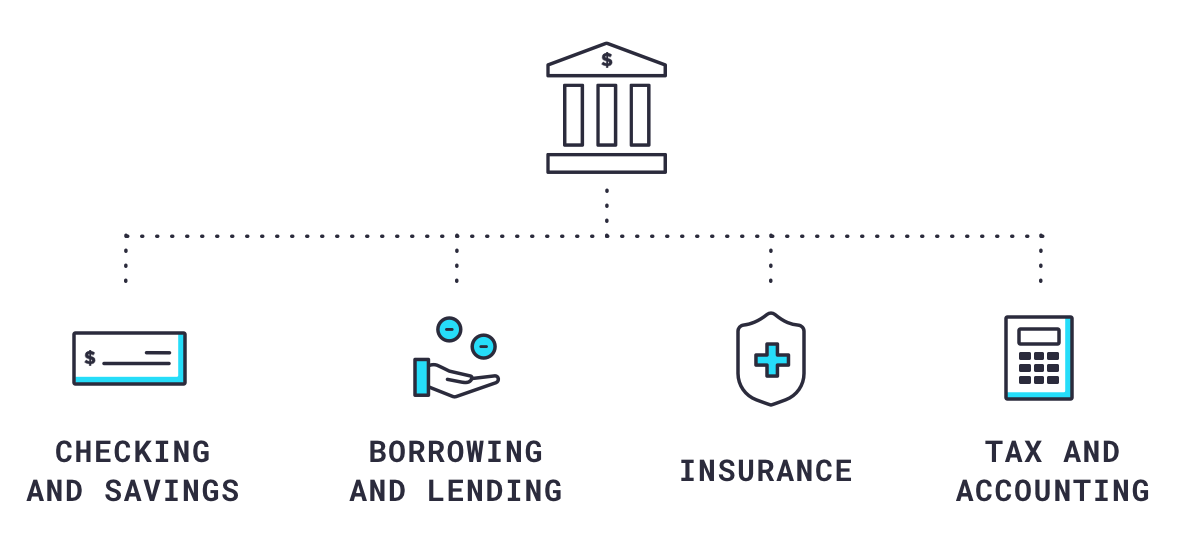

However, financial services go way beyond payments to services such as checking and savings, borrowing and lending, insurance, taxes and accounting and so on. The idea behind DeFi should now be fairly apparent: to decentralize all financial services using blockchain protocols and cryptocurrencies.

The main backbone of today’s DeFi movement is , a decentralized blockchain that enables smart contracts upon which other decentralized blockchain-based applications () with native cryptocurrencies can be built. The Compound protocol is primarily concerned with the financial services of borrowing and lending your crypto.

Earn Interest With Compound Lending

Here’s how it works. Compound supports the borrowing and lending of a specific set of cryptocurrencies. As of this writing, they are: Dai (DAI), Ether (ETH), , Ox (ZRX), Tether (USDT), (WBTC), Basic Attention Token (BAT), Augur (REP), and Sai (SAI). Now anyone with crypto can lend and borrow crypto immediately, without having to spend the time, effort, and cost of dealing with a traditional financial intermediary.

If you own any of the cryptocurrencies mentioned above, you can send, lock, deposit, lend – they all mean the same thing – any amount you wish to the Compound protocol. Locking your crypto in with Compound is just like putting your money in a savings account, but with a decentralized, blockchain-based protocol. Instead of depositing your money into the bank, you are sending your crypto to the Compound wallet. And, just like lending to a bank, you immediately begin to earn interest on your crypto. The interest you earn is denominated in the same token that you lent – meaning, if you sent BAT you earn interest in BAT, if you sent DAI you earn DAI etc. The crypto you send is added into a giant pool of that same token in a smart contract in the Compound protocol, sent by thousands of other people all over the world.

Compound Crypto Borrowing

On the other side of the equation is borrowing. Once you’ve locked your crypto to Compound, you are able to borrow against it. Compound does not require a credit check so anybody anywhere in the world with crypto has the ability to borrow. Compound determines how much you are allowed to borrow based on the quality of the asset. So, for example, if you sent 1000 BAT worth $500 and Compound has set the borrowing limit (aka collateral factor) for BAT at 50%, you can borrow $250 worth of any other crypto that the Compound protocol supports (see list above). And, just like borrowing money from a bank, you need to pay interest on the money you borrow.

So, we have lending and we have borrowing, both of which concern themselves with interest rates. For lending, you earn interest. For borrowing you pay interest. Let’s take a minute to talk about how those interest rates are calculated and automatically implemented by the Compound protocol.

Why Compound Borrowing and Lending Rates Fluctuate

Remember that regardless of whether you are lending or borrowing, you first have to lock in crypto with Compound. When you do, you get Compound tokens (cTokens), which represent the balance of your crypto, in return. are created from Ethereum as and are one of the great benefits and innovations of a blockchain-based crypto money market; they can be transferred, traded, or programmed into other Dapps in the DeFi ecosystem similar to other Ethereum tokens, all while earning (or paying) interest. You control these cTokens just like you would control any digital asset on the Ethereum blockchain, with your public and private keys.

Interest rates are a function of the amount of crypto available (aka liquidity) in each market and fluctuate in real-time based on supply and demand to always reflect current market conditions. The interest rates you see are quoted as annual interest rates and accrue each time an Ethereum block is mined. Every 15 seconds the value of your cTokens will increase by 1/2102400 (which is the number of 15 second blocks in a year) of the quoted annual interest rate at that time.

How Compound Crypto Liquidity Pools Work

When there is a large pool of crypto locked in Compound, interest rates are low because there’s plenty there to be borrowed so you’re not getting paid a lot to add to that large pool. If the pool is small, interest rates are higher and you earn more. Fluctuating (aka floating) interest rates incentivizes lending new crypto to small pools (to earn higher interest), and repaying borrowed crypto into small pools and borrowing from large pools (to pay less interest).

As we’ve mentioned above, every time you borrow from Compound you have to lock in crypto that’s worth more than what you borrow as collateral so that the loan you take is over collateralized. Since the crypto you deposit as collateral is also volatile, it could drop in value. As it approaches the value of the crypto you’ve borrowed the cToken smart contract automatically closes the position. This is called liquidation (or, margin call). In that case, you get to keep what you borrowed but you lose your collateral.

The Compound Protocol’s COMP Crypto Asset

COMP is the of the Compound protocol and a predetermined amount is distributed to all lenders and borrowers on the Compound protocol every day. distributions happen every time an Ethereum block is mined (every 15 seconds) in an amount proportional to the interest accrued by each asset. COMP token-holders propose and vote on changes to the protocol, and oversee the protocol’s reserves and treasury; every COMP token represents one vote, which can even be delegated to another party on your behalf.

Compound governance proposals are executable code which is subject to a three-day voting period. If a governance change to the protocol is passed by the community it will take effect two days later giving anyone a chance to close any open positions before the changes go into effect. In this way, Compound is an entirely self-governed ecosystem.

Compound and its native COMP governance token are bringing the benefits of blockchain to lending and borrowing crypto in a rapidly expanding DeFi ecosystem.

Cryptopedia does not guarantee the reliability of the Site content and shall not be held liable for any errors, omissions, or inaccuracies. The opinions and views expressed in any Cryptopedia article are solely those of the author(s) and do not reflect the opinions of Gemini or its management. The information provided on the Site is for informational purposes only, and it does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. A qualified professional should be consulted prior to making financial decisions. Please visit our to learn more.

Author

Is this article helpful?