Institutions

INSTITUTIONAL PRODUCTS

WHO WE SERVE

Gemini Foundation

Gemini Crypto Derivatives

A Non-US Crypto Derivatives Platform

Gemini Foundation’s derivatives product is available in select jurisdictions globally. It is not currently available in the US, UK, or EU.

Crypto Derivatives Metrics

A comprehensive and up-to-date overview of crypto derivative spreads, trading volumes and more, on our platform.

%

Bid : Ask Spread

$30.55M

Weekly Trading Volume

65µs

Average Execution Time

100x

Maximum Leverage

The Best Crypto Derivatives Exchange

Gemini Derivatives allows customers to leverage their crypto assets to manage risk, generate returns, and gain directional exposure — all within the secure and trusted platform.

Gemini Derivatives offers perpetual contracts, with dated futures and options trading coming soon. Available via ActiveTrader only.

The Gemini Leaderboard

Enter to compete for the top spot in our daily competitions and walk away with prizes.

Leaderboard Competitions

P&L Playoff

The top daily trader with the highest profit achieved, including realized and unrealized, wins $500 GUSD.

= Trader with the most P&L Playoff wins per month takes home $5,000 GUSD.

| Rank | Geminym | Share |

|---|---|---|

1 | - | |

2 | - | |

3 | - | |

4 | - | |

5 | - |

1

-

2

-

3

-

4

-

5

-

Resources

The latest news and insights on crypto derivatives

BLOG MAR 07, 2024

Introducing the BNB/GUSD and INJ/GUSD Perpetual Contracts on Gemini’s Non-US Crypto Derivatives Platform

BLOG MAR 01, 2024

Introducing Five New Perpetual Contracts on Gemini’s Derivatives Platform: AVAX/GUSD, DOGE/GUSD, DOT/GUSD, LINK/GUSD, LTC/GUSD

BLOG FEB 19, 2024

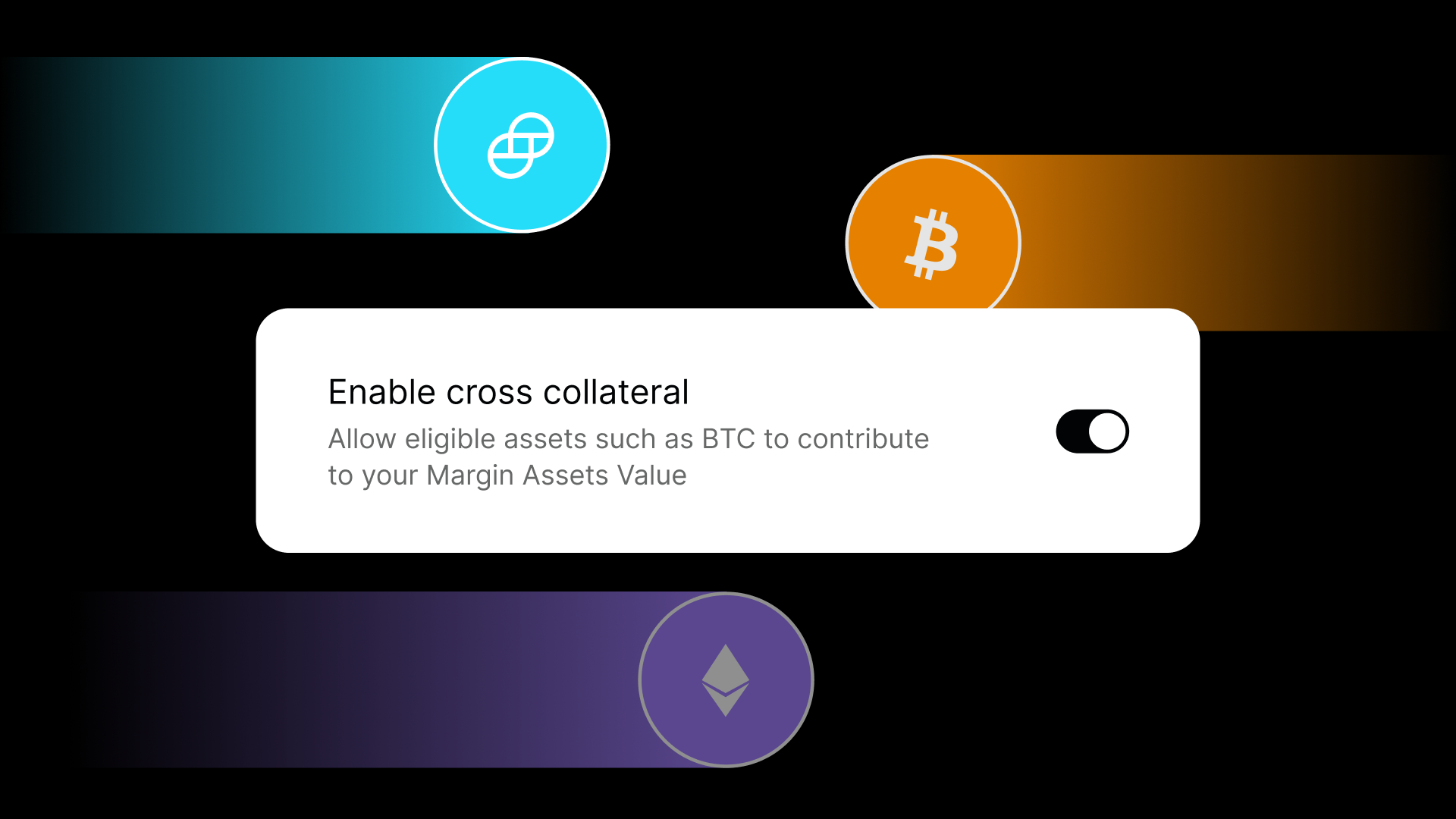

Introducing Cross Collateral for Derivatives Trading

Perpetual Contracts and Trading

No expiry date

A perpetual contract is similar to a crypto futures contract with one key difference - there is no expiry date. Traders can hold a position open as long as their margin is sufficient. With Gemini’s cross collateral feature, traders can leverage multiple assets as margin.

Custody-free exposure

Perpetuals derive their value from the underlying asset. This means traders are able to gain exposure to a crypto asset without having to hold it.

Trade both directions

Traders can long or short perpetual contracts, allowing them to benefit from prices moving both up and down.

Trade crypto derivatives with Gemini ActiveTrader™

ActiveTrader is a high-performance crypto trading platform that delivers a professional-level experience.

Execute buy and sell orders anytime

ActiveTrader features advanced charting, multiple order types, auctions, and block trading for your derivative trading needs. Available on web and through a mobile web browser.

Access to full API suite

Trading services and market data are easily accessible through multiple API options - including WebSockets, FIX, and public and private REST APIs.

Top-tier Liquidity Partners

In order to ensure liquidity at all times, Gemini partners with the largest market makers to provide the best pricing available for users.

How to start trading Crypto Derivatives

Customers must reside in any of the supported countries and have a Gemini account in order to open a Gemini Derivatives account. In order to do so, please follow the steps below:

What countries is the Gemini Crypto Derivatives offering available in?

Gemini Derivatives, a Gemini Foundation product, is currently available to customers in Argentina, Bahamas, Bermuda, Bhutan, Brazil, British Virgin Islands (BVI), Cayman Islands, Chile, Costa Rica, Dominican Republic, Ecuador, Egypt, El Salvador, Guernsey, Hong Kong, India, Israel, Jersey, Mexico, New Zealand, Nigeria, Panama, Peru, Saint Lucia, Saint Vincent & Grenadines, Singapore, South Africa, South Korea, Switzerland, Taiwan, Thailand, Turkey, Uruguay, Vietnam.

We are actively pursuing an expansion of additional jurisdictions. Stay tuned to this page for the latest updates.

What derivatives contracts are available for trading?

The following perpetual contracts are available for trading:

- AVAX/GUSD

- BTC/GUSD

- DOGE/GUSD

- DOT/GUSD

- ETH/GUSD

- LINK/GUSD

- LTC/GUSD

- MATIC/GUSD

- PEPE/GUSD

- SOL/GUSD

- WIF/GUSD

- XRP/GUSD

Gemini plans to expand its derivatives offering with additional perpetual contracts, dated futures, and options trading soon. Stay tuned to our blog for the latest updates.

Who is allowed to trade Gemini Crypto Derivatives contracts?

Gemini Derivatives is available to both retail and institutional Gemini customers who reside in any of the eligible jurisdictions.

What are perpetual contracts?

Perpetual contracts are financial instruments that allow traders to gain exposure to the price of a crypto asset in a manner similar to conventional futures contracts. The main difference is that perpetual contracts do not have an expiration date.

How much leverage does Gemini offer?

Gemini offers up to 100x leverage for BTC, ETH, PEPE, XRP, SOL, and MATIC perpetuals. Leverage is set at the account level and the default is up to 20x. This can be increased at any time by the customer and decreased provided they have enough Margin Assets Value to adhere to the higher Initial Margin requirements.

The amount of leverage that can be taken is a function of the position size. The larger the position size, the lower the amount of leverage that is made available to the customer by Gemini.

For more details, visit this page.

What options are available for collateral?

You can deposit both GUSD and BTC as collateral to trade derivatives on Gemini.

What is Initial Margin?

Initial margin is the amount a trader must deposit in order to initiate a trading position.

What is Maintenance Margin?

Maintenance Margin is the minimum amount you must hold to keep a position open. If your margin assets value drops below this level, your position will be liquidated.

What are the fees for trading Gemini Crypto Derivatives?

Gemini Perpetual Fees

| Trailing 30D ADV (USD) | Maker Fee | Taker Fee |

|---|---|---|

| 0 | 0.02% | 0.07% |

| ≥ $10,000 | 0.02% | 0.06% |

| ≥ $50,000 | 0.02% | 0.05% |

| ≥ $100,000 | 0.02% | 0.05% |

| ≥ $1,000,000 | 0.02% | 0.05% |

| ≥ $5,000,000 | 0.01% | 0.04% |

| ≥ $10,000,000 | 0.00% | 0.04% |

| ≥ $50,000,000 | -0.01% | 0.04% |

| ≥ $100,000,000 | -0.01% | 0.03% |

| ≥ $500,000,000 | -0.01% | 0.03% |

Maker fees for large volume traders are negative, this means any customer qualifying for these fee tiers will receive a rebate from Gemini on maker trades.

How do I place my first derivatives trade?

If you have yet to create a Gemini account and reside in a derivatives-enabled jurisdiction, sign up for an account here to receive both a spot and derivatives trading account.

For current Gemini spot users in derivatives-enabled jurisdictions, follow the steps below to activate your derivatives account today.

- Log on via desktop or mobile web browser

- Select the Account drop-down list at the top left of your screen

- Select “Activate Now” next to the Derivatives Account option to begin the activation process

- Read and accept the derivatives-specific terms and conditions

- Transfer GUSD to your derivatives account

- Start trading!

What are the risks associated with trading derivatives?

For perpetual contracts, customers have the option to trade using leverage. As such, the capital required to have in a customer’s Gemini Derivatives account to trade a perpetual contract may be significantly less than the total notional value of the trade.

This means that a customer may lose all of their funding capital should the market move against them. In order to maintain the integrity of Gemini's derivatives market, customers who trade the perpetual contracts will be subject to an auto-liquidation feature. Positions will be automatically closed once the risk of a customer’s position is too high in comparison to the funds in their account. Cryptocurrencies are volatile and leverage amplifies this so it is possible for a customer to accumulate losses quickly.

Gemini’s derivatives contracts can only be traded on the ActiveTrader platform and cannot be moved over to, or traded on, another exchange. Positions must be opened and closed on Gemini’s ActiveTrader platform.

What are the Terms and Conditions for Gemini Derivatives?

You can find the full Terms and Conditions here.

Trading Gemini Crypto Derivatives and other instruments using leverage involves an element of risk. Investing in crypto derivatives may not be suitable for everyone. Clients should read Gemini’s risk disclosure to learn about relevant risks before investing in Gemini Crypto Derivatives. Gemini Crypto Derivatives cannot be traded by individuals or institutions based in the U.S., for a full list of available jurisdictions, please visit the Gemini Crypto Derivatives product page.