FEB 28, 2025

Crypto Market Q&A: Digital Assets Need More Positive Momentum for Prices To Push Higher Again

After surging to an all-time high of nearly $110,00 in mid-December, the price of bitcoin has since experienced a protracted three-month lull, followed by a recent decline. This downturn was influenced by broader macroeconomic concerns—including tariffs, persistent inflation, and slowing economic growth—as well as the Bybit hack, which dented market confidence.

As of Thursday, the price of bitcoin had pulled back to $84,000, ether to below $2.300, Solana to around $137 and XRP to $2.19. Solana, in particular, has been crushed from a series of memecoin-related controversies that have turned off some investors, tumbling more than 40% percent over the past month.

Despite these challenges, there are still plenty of greenshoots in the crypto ecosystem. The SEC has recently dropped pending enforcement actions against Gemini, Coinbase, Uniswap, and other firms. Meanwhile, Michael Saylor’s Strategy has amassed nearly 500,000 bitcoin and has shown no appetite to stop using convertible debt to buy more. And more than a dozen U.S. states have introduced legislation aimed at creating a crypto buying program.

In other words, it’s a confusing time in crypto. So we’ve gone looking for answers. To provide insights into these market dynamics, earlier this month Gemini launched “Crypto Markets Q&A”—a bi-monthly conversation with Patrick Liou, Gemini’s Associate Director of Institutional Sales.

In a recent Weekly Market Update, Liou offered his take on tariffs, macroeconomic conditions he’s monitoring, and why crypto prices have yet to rally under president Donald Trump’s pro-crypto administration.

Q: Generally speaking, which US macroeconomic indicators (i.e. jobs reports, interest rates, regulation) are we looking at here over the next few months to see how it will impact the crypto space? Is there one that we think is more important than the other?

Liou: The most important macroeconomic indicators will continue to be inflation data such as the consumer price index and personal consumption expenditures, because it is the primary determinant of the future interest rate path for the Federal Reserve (and other global central banks). For example, Wednesday’s CPI data showed inflation rose 3% YoY, an uptick from 2.9% YoY in December. As a result, stocks and crypto markets traded lower while yields rose.

Sticky and stubborn inflation data will likely leave rates at a “higher for longer” environment, while evidence of sustained cooling may greenlight the Fed to lower rates, which will be positive for crypto and risk assets generally. As a result, stocks and crypto markets traded lower while yields rose.

Q: President Donald Trump has doubled down on the crypto space in his first few weeks in office, launching his own memecoin, signing an executive order to set up a strategic working group to look at a bitcoin reserve, and repealing SAB 121. Why do you think prices have yet to reflect these positive greenshoots?

Liou: All these positive headlines are reflected in the price action - it’s just that the greenshoots started to occur as soon as Trump appeared on track to a victory on election night. Recall the price of bitcoin was just a shade below $70K on election day. Just over a month later, bitcoin hit the $100K milestone for the first time. One could argue that the markets were efficient in pricing in the subsequent positive headlines mentioned above and the price today is justified as such.

Looking ahead, crypto markets will need incremental headlines for a further rally higher, such as nations/states/corporations allocating bitcoin on their balance sheets or stronger than expected follow through on what the market is expecting from the Trump administration.

In addition, there have been a few macroeconomic headwinds, such as Deepseek and its implications on the GPU markets and the return of tariffs, that have been causing volatility in traditional markets that have spilled over to crypto markets.

Liou: Should crypto investors be worried about tariff tensions between the US and other countries? Are we expecting these to have more of a short-term impact or do they have the potential to have long-term ramifications for the crypto space?

Yes, tariffs will create short term volatility in crypto markets and risk assets as a whole. We have already seen evidence of this with the tariffs to Canada, Mexico, and China and on aluminum products. Moreover, many of these tariffs have been announced during the weekends, when traditional markets are closed but crypto is open. This has led to sharp selloffs in crypto markets after the weekend tariff announcements as the only liquid trading market open.

Tariffs are inherently inflationary, which will create impacts as detailed in the first question above. However, President Trump is citing the use of tariffs as a way to bring counterparts to the negotiation table, instead of a long-term approach in imposing tariffs. This will be critical in determining what the implications of tariffs on crypto markets will be in the short and long term.

*Have any topics you want tackled? Email and we’ll work in your questions for a future edition of Crypto Markets Q&A. *

RELATED ARTICLES

COMPANY

DEC 15, 2025

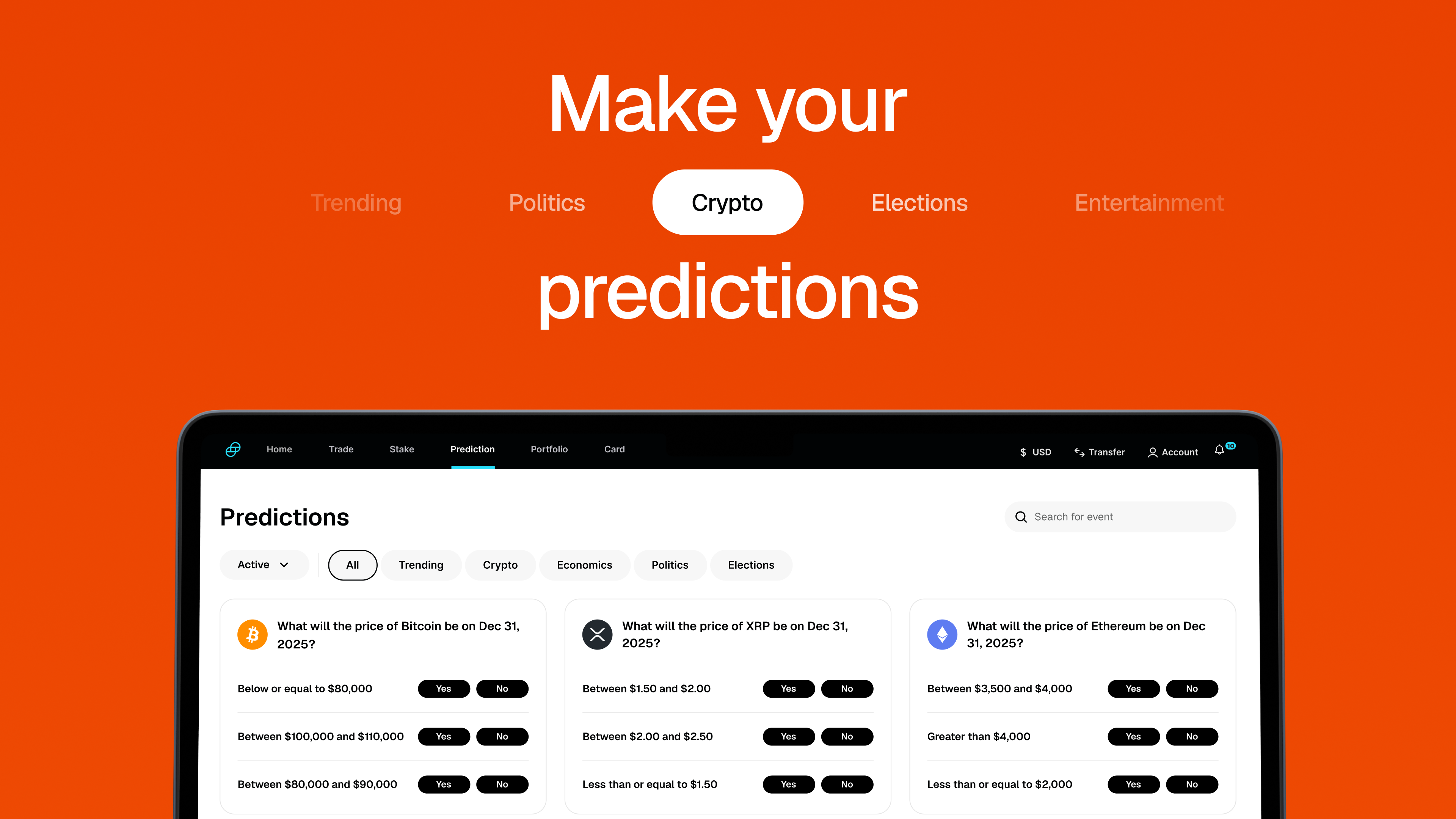

Gemini Predictions™ Is Now Live

WEEKLY MARKET UPDATE

DEC 11, 2025

Federal Reserve Cuts Rates Again, SEC Proposes New Token Guidelines, and BlackRock Applies for Ether Staking ETF

COMPANY

DEC 10, 2025