Página inicial do blog

DERIVATIVES

FEB 19, 2024

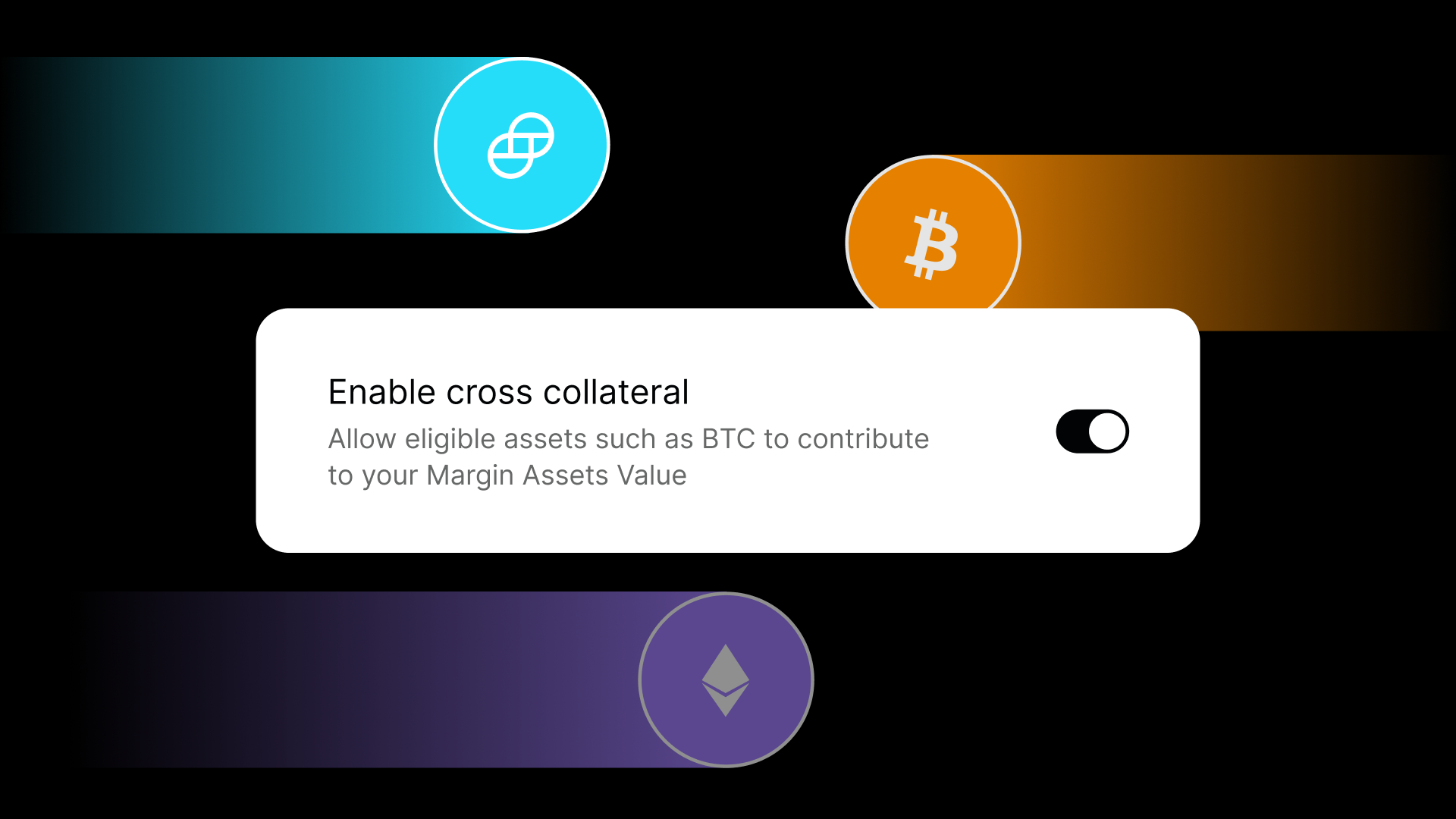

Introducing Cross Collateral for Derivatives Trading

Today, we’re thrilled to announce the immediate availability of cross collateral on the Gemini derivatives platform — providing you with more flexible funding options.

With the introduction of cross collateral, you are no longer limited to only posting GUSD as collateral to trade derivatives on Gemini. You can now also leverage your BTC holdings to trade derivatives, with ETH collateral becoming available in the coming weeks.

What is Collateral and Cross Collateral?

When trading derivatives, you are required to deposit funds, known as collateral, in order to open and maintain derivatives positions. The collateral required to open a position is your Initial Margin. The collateral required to keep your position open is known as Maintenance Margin, and the total amount of collateral available for trading is your Margin Assets Value.

To learn more about margin, check out our article: Gemini Foundation Academy: Understanding Margin and Leverage.

Collateral serves as a buffer to cover potential losses in the event that your position moves against you. You are required to hold sufficient collateral to meet margin requirements, and keep in mind that collateral assets are at risk of liquidation if margin requirements are not met.

Here’s where cross collateral comes in. Until today, when trading derivatives on Gemini you could only deposit GUSD as collateral to open and maintain derivatives positions. With the introduction of the new cross collateral feature, you can now use BTC, and soon ETH, as collateral for your trades. Keep reading for an example of how this works.

Cross Collateral In Action

Bob only holds BTC in his Gemini account and wants to open a derivatives position to reflect his short-term view on the price of PEPE. Prior to our new cross collateral feature, Bob would have only been able to use GUSD to trade derivatives on Gemini. This means he would have had to convert some of his BTC holdings into GUSD to trade PEPE derivatives, and in turn lose some of his exposure to BTC.

Now, with cross collateral, Bob has more options. He can directly deposit BTC as collateral to open a position without having to sell some of his BTC for GUSD.

The cross collateral feature provides customers like Bob with greater flexibility and capital efficiency. Customers like Bob can now pursue trading strategies while retaining exposure to their chosen assets.

How to Open a Derivatives Account

If you have yet to create a Gemini account and reside in a derivatives-enabled jurisdiction, sign up for an account here to receive both a spot and derivatives trading account.

For current Gemini spot users in derivatives-enabled jurisdictions, follow the steps below to activate your derivatives account today.

- Log on via desktop or mobile web browser

- Select the Account drop-down list at the top left of your screen

- Select “Activate Now” next to the Derivatives Account option to begin the activation process

- Read and accept the derivatives-specific terms and conditions

- Transfer GUSD or BTC to your derivatives account

- Start trading!

The introduction of the cross collateral feature marks a significant step forward in enhancing the trading experience on the Gemini derivatives platform. Stay tuned for more updates, features, and opportunities that will empower you to efficiently navigate the crypto derivatives market with confidence.

For more details on using cross collateral, please visit our Support page.

Onward and Upward,

The Gemini Derivatives Team

ARTIGOS RELACIONADOS

WEEKLY MARKET UPDATE

FEB 13, 2025

Powell Calls for Review of Crypto Debanking, Inflation Trends Higher, and States Consider Bitcoin Reserves

COMPANY

FEB 11, 2025

Gemini Receives In-Principle Approval for Investment Firm Licence to Offer Perpetuals Throughout the EU

WEEKLY MARKET UPDATE

FEB 06, 2025