JUN 20, 2024

Bitcoin Price Dip Triggers Nearly Half a Billion in Liquidations, Telecom Giant Enters Bitcoin Mining Space, and SEC Abandons ETH Investigation

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we look at use cases for the Shiba Inu memecoin.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | -3.14% | $64,712.57 |

$64,712.57

-3.14%

| |

Ether

ETH | +1.49% | $3,516.00 |

$3,516.00

1.49%

| |

Chiliz

CHZ | -30.4% | $0.0807 |

$0.0807

-30.4%

| |

Ethereum Name Service

ENS | +29.5% | $25.627 |

$25.627

+29.5%

| |

Curve

CRV | +15.2% | $0.341 |

$0.341

+15.2

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, June 20, 2024, at 1:33 pm ET. . All prices in USD.

Takeaways

- Bitcoin prices fell Monday as nearly $500 million in positions were liquidated: Over the past two weeks, bitcoin whales have sold off almost $1.2 billion, primarily through brokers.

- Deutsche Telekom, parent company of T-Mobile, to join Bitcoin mining sector: The move could enhance network security but also increase competition among miners.

- Consensys says SEC has ended its Ethereum 2.0 investigation: The announcement confirmed that ETH sales are not securities transactions – marking a significant victory for the space.

- The Financial Stability Board met in Toronto to discuss regulatory challenges presented by stablecoins: The collaboration with the IMF began last year, with plans to produce a policy paper on the issue.

- Waka Flocka Flame's new memecoin, FLOCKA, launches on the Solana blockchain, faces criticism amid a roughly 77% price drop: The massive falloff created an uproar from buyers who felt deceived by a social media post supporting the launch.

Crypto Market Sees Nearly $500M in Liquidations in 24 Hours as Prices Dip

Overall, $489 million in liquidations occurred, with long positions bearing the brunt of the losses at over $432 million. The majority of these liquidations happened over 12 hours, coinciding with Bitcoin's price falling to $64,548 and Ethereum dipping to $3,384.

The trend of liquidations started the day prior, with $290 million being wiped out. Ether led the liquidation volume with $92.5 million, followed by bitcoin at $72.8 million and DOGE at $60.3 million. SHIB and Solana also saw significant liquidations at $22.9 million and $19.8 million, respectively.

Long-term bitcoin investors and miners reportedly accounted for much of the sell-off, with the latter reportedly looking to pivot into AI computing to boost revenue after the Bitcoin halving event cut rewards by 50%.

Deutsche Telekom Ventures into Bitcoin Mining

This news arrives amid significant fluctuations in the mining sector, which has navigated a bull market in 2021, a subsequent crypto winter, and the latest halving.

Although specifics on the scale and location of Deutsche Telekom's mining operations were not disclosed, the market is still unsure as to whether the effect of such a large company entering the space would be beneficial. On one hand, a corporation with a market cap exceeding $200 billion could enhance Bitcoin's network security and bolster the mining industry’s credibility. On the other hand, this move could intensify competition for current miners.

Deutsche Telekom already has a strong presence in the digital assets sector, operating validators on networks like Polygon, Chainlink, and Ethereum. Last year, the company launched the Energy Web Chain, the first public blockchain designed specifically for the energy sector, aimed at promoting a decentralized, digitalized, and decarbonized energy system.

The company has also been running a Bitcoin node and Lightning nodes since 2023. This development has been generally welcomed by the Bitcoin mining community, though it also highlights the increasing competitive pressures on smaller mining operations.

Consensys Claims Victory as SEC Ends Ethereum 2.0 Investigation

The company said the news was a major triumph for the Ethereum network and beyond.

The company took to X to make the announcement, celebrating the SEC’s move to stop pursuing charges that ether sales are securities transactions. This decision comes after Consensys sent a letter on June 7, seeking clarification on whether the approval of spot ether exchange-traded funds (ETFs) in May would terminate the Ethereum 2.0 investigation. The ETF approvals, though still pending finalization, were premised on ether being classified as a commodity.

In April, Consensys received a Wells notice indicating potential enforcement action from the SEC. While SEC Chair Gary Gensler has refrained from definitively stating whether ether is a security, Commodity Futures Trading Commission Chair Rostin Behnam has classified ether as a commodity.

Earlier this year, Consensys also filed a lawsuit against the SEC challenging its designation of ether as a financial security. For now however, the heated exchange seems to have somewhat calmed in favor of the industry with this latest ruling.

FSB to Address Stablecoin Challenges in Emerging Economies

This decision was made during a recent plenary meeting in Toronto, as stated in a Friday announcement.

The FSB, a key player in shaping global crypto policies, collaborated with the International Monetary Fund (IMF) last year to produce a policy paper on crypto. The paper advised against banning stablecoins outright for certain purposes, and highlighted the need for nuanced approaches to mitigate sector risks. At the recent meeting, FSB members identified specific areas within the crypto sector requiring further attention, particularly stablecoin regulation.

Stablecoin regulation in particular remains a contentious economic issue between the G7 nations and the broader G20 group. Despite the discussions, these differences were not resolved even as the G7 summit in Italy concluded last week. The ongoing debate underscores the complexities involved in achieving global consensus on stablecoin regulation.

Waka Flocka Flame's FLOCKA Memecoin Faces Scrutiny and Decline

Early Monday, he shared the token's ticker and contract address with his 1.8 million followers on the social media platform X, alongside a video. However, widely-known blockchain investigator ZachXBT quickly pointed out suspicious activity, revealing that a newly funded wallet had snapped up around 40% of FLOCKA's supply and dispersed it across multiple wallets. This prompted community members to propose notes warning of potential selling pressure.

Criticism followed when on-chain data indicated that FLOCKA had been live for at least an hour before Malphurs made his social media post. Users felt deceived, with one commenting that the contract address should have been shared during the initial price surge, not after.

-Team Gemini

data as of 2:30 pm ET on June 20, 2024.

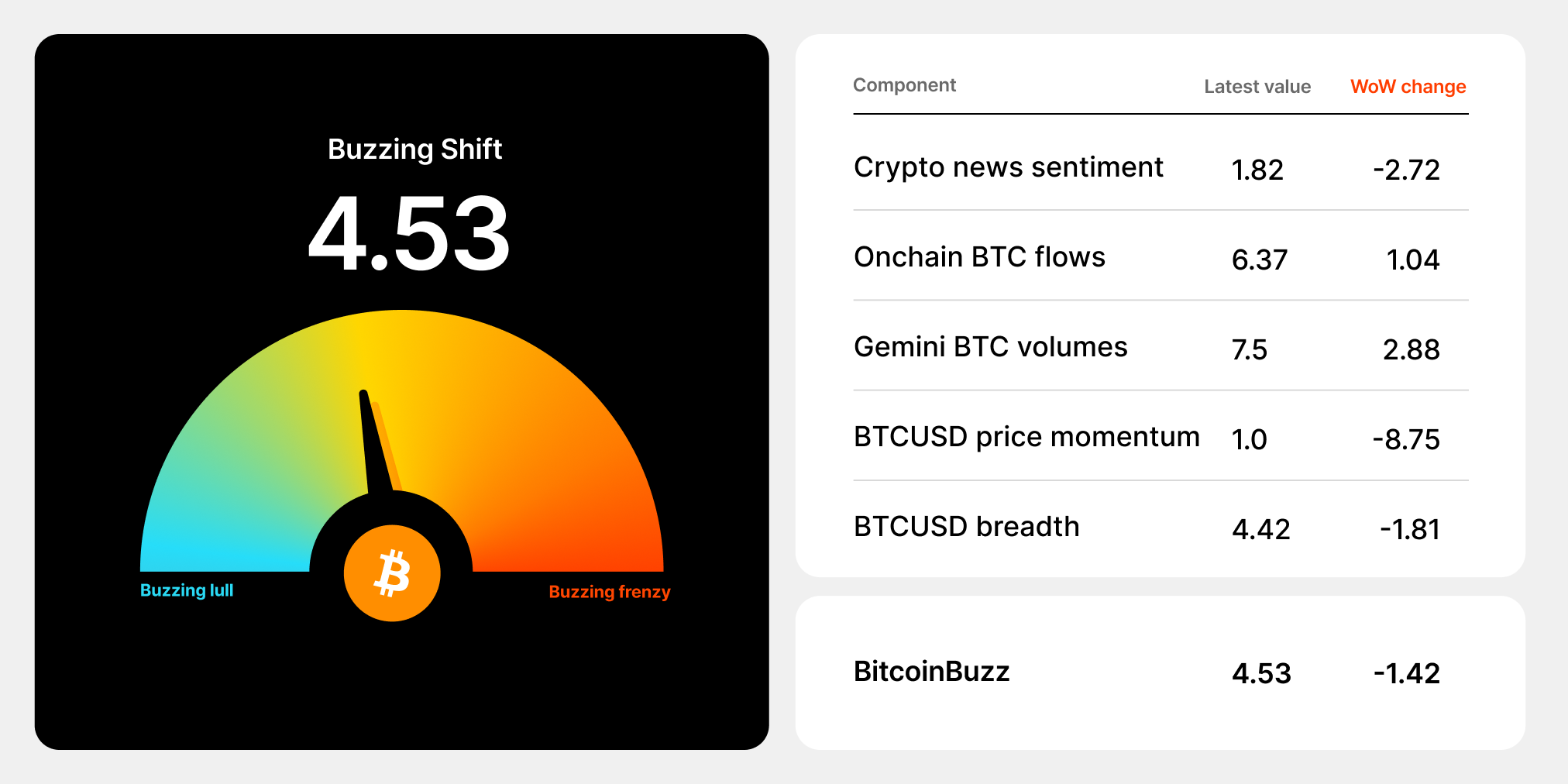

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Shiba Inu: The Doge-Inspired Upstart Memecoin

Although Shiba Inu (SHIB) started off as a lighthearted blockchain experiment focused on informal community governance, the project has made significant attempts to differentiate itself from Dogecoin (DOGE) and other memecoins by establishing a unique three-token ecosystem with clearly stated use cases.

BONE, LEASH, and SHIB tokens are interoperable ERC-20 tokens that furnish use cases like decentralized exchange (DEX) ShibaSwap, community-wide charitable initiatives, and a non-fungible token (NFT) incubator. The project earned worldwide headlines after the meteoric rise of its SHIB token, as well the project’s tokenomic liquidity gambit involving Ethereum creator Vitalik Buterin.

Onward and Upward!

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

DEC 15, 2025

Gemini Predictions™ Is Now Live

WEEKLY MARKET UPDATE

DEC 11, 2025

Federal Reserve Cuts Rates Again, SEC Proposes New Token Guidelines, and BlackRock Applies for Ether Staking ETF

COMPANY

DEC 10, 2025