Safeguard your digital assets with secure and regulated cold storage

Gemini Custody® uses multi-party technology, role-based governance protocols, physical security, and multiple layers of biometric access controls to safeguard customer assets.

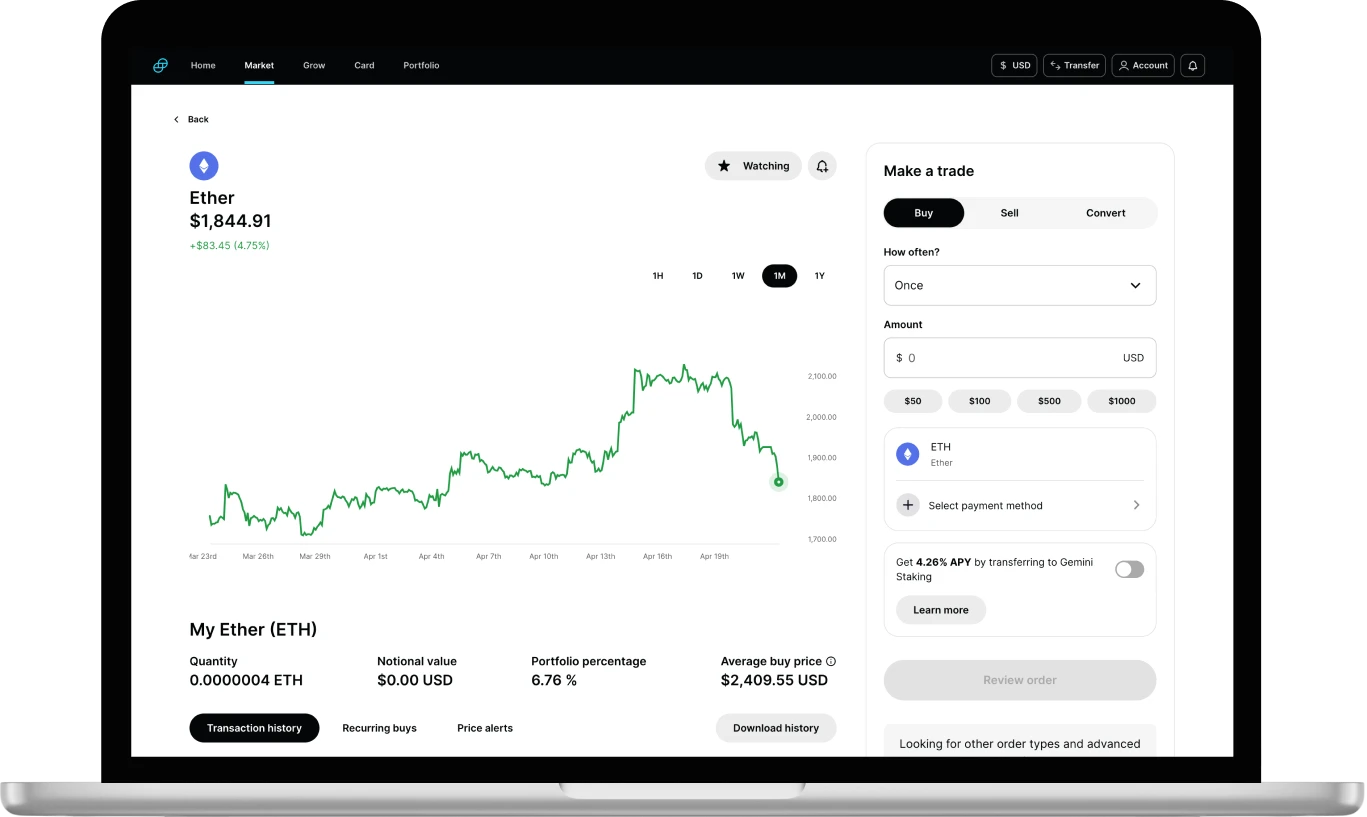

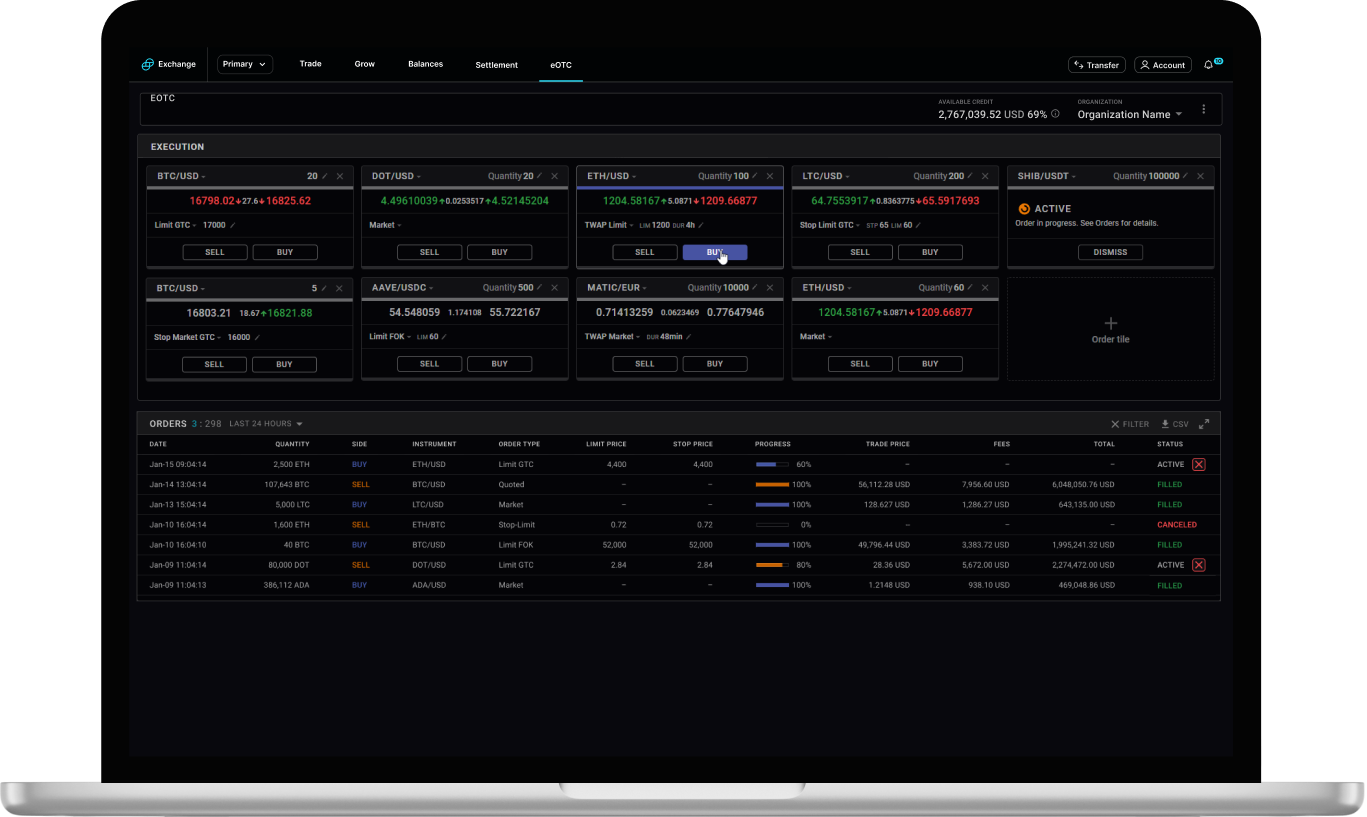

Seamlessly integrated for ease of use Easily check balances, initiate withdrawals, access monthly statements, and transfer assets in Gemini’s secure self-service account portal or through APIs. Gemini Custody integrates seamlessly with the Exchange dashboard.

Instant trading from cold storage Trade directly with assets held in offline storage with Gemini Instant Trade®. Withdrawals to exchange accounts are instantly credited for trading while maintaining the highest security and verification standards*. *ISO 27001 and SOC 2 Type 2 certified.

Seamlessly integrated for ease of use Easily check balances, initiate withdrawals, access monthly statements, and transfer assets in Gemini’s secure self-service account portal or through APIs. Gemini Custody integrates seamlessly with the Exchange dashboard.

Instant trading from cold storage Trade directly with assets held in offline storage with Gemini Instant Trade®. Withdrawals to exchange accounts are instantly credited for trading while maintaining the highest security and verification standards*. *ISO 27001 and SOC 2 Type 2 certified.

Designed for compliance and transparency

All customer assets are segregated using unique digital addresses that are independently verifiable on their respective blockchains. Give auditors view-only access into balances, transactions, and activity.

Uncompromisingly Offline

Hardware security modules storing private keys are never connected to the internet and have achieved the highest levels of U.S. government security ratings. Geographically distributed secured facilities cannot be accessed without the proper credentials.

Regulated, Licensed, Insured

Gemini is a fiduciary and qualified custodian under New York Banking Law and is licensed by the State of New York to custody digital assets. Gemini Custody® secured $100 Million in cold storage insurance coverage for certain types of crypto losses from our Custody platform.

Custody Use Cases

Institutional Investors

Gemini Custody® offers tailored pricing plans to fit your trading volume, asset mix, and size of holdings – without compromising on our industry-leading security and institutional-grade crypto storage.

Private Wealth

Easily check balances, initiate withdrawals, access monthly statements, create sub-accounts, and transfer assets in Gemini’s secure self-service account portal. Gemini’s custody interface integrates seamlessly with the Gemini Exchange dashboard.

Businesses

Feel confident knowing your company’s assets are secure. As a regulated New York State Trust Company, Gemini is a fiduciary and qualified custodian under New York Banking Law Customer funds held on Gemini are held 1:1 and available for withdrawal at any time.

Related Products

Questions? Answers

What is Gemini Custody?

Gemini Custody provides a solution to store your crypto in a regulated, secure, and compliant manner with our secured offline storage systems.

What cryptos are supported on Gemini Custody?

Over 100 cryptocurrencies are available to custody, including BTC and ETH. View the full list

How safe is Gemini Custody?

Security has been ingrained in Gemini’s history and culture from day one. Gemini’s Security team is one of the largest teams at Gemini, and maintains strong relationships with all business units to ensure Security is top of mind for all employees.

All of our segregated custody assets and the majority of our exchange wallet assets are held in our offline, air-gapped storage systems. We use multi-party technology, role-based governance protocols, and multiple layers of biometric access controls and physical security to safeguard client assets.

Are my assets in Gemini Custody Insured?

As of March 1, 2024, Gemini maintains $125M in digital asset insurance for certain types of losses, in addition to the capital reserves required of Gemini Trust Company, LLC as a New York limited purpose trust company and fiduciary under New York Banking Law. This consists of $25M of commercial crime insurance for digital assets held in our Hot Wallet, and $100M of offline ("cold storage") insurance coverage for assets held.

Is there a minimum balance required to use Gemini Custody?

There is no set minimum balance, however there is a minimum monthly fee of $30 per asset required to create and maintain a Gemini Custody account.

What are the fees associated with Gemini Custody?

Please visit our Custody Fee Schedule page to view the latest fees.

Resources

Gemini Custody Tear Sheet

Download PDF