MAR 28, 2024

BTC Pushes Back Above $70K Amid LSE Crypto ETN News, BTC ETFs Reverse Outflow Trend, While BlackRock Shows Further Commitment to Digital Assets With BUIDL Launch

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic —this week we revisit the halving and its impact on crypto markets.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +6.04% | $70,815.05 |

$70,815.05

+6.04%

| |

Ether

ETH | +0.94% | $3,553.35 |

$3,553.35

+0.94%

| |

STEPN

GMT | +39.13% | $0.40005 |

$0.40005

+39.13%

| |

Bicoin Cash

BCH | +33.42% | $569.72 |

$569.72

+33.42%

| |

Dogecoin

DOGE | +27.99% | $0.22022 |

$0.22022

+27.99%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, March 28, 2024, at 2:00pm ET. . All prices in USD.

Takeaways

- LSE announces launch of new crypto ETNs as BTC ETFs reverse outflow trend: The London Stock Exchange announced this week that they plan to launch BTC and ETH ETNs by the end of May, signaling further ongoing interest in crypto-related products. Coupled with a reversal in BTC ETF outflows, these developments have helped to renew market optimism and push the price of BTC back above the $70K level, a +15% rise from the low of $61K only one week ago.

- BlackRock steps further into digital assets with launch of BUIDL: The BlackRock USD Institutional Digital Liquidity Fund, called BUIDL, will allow qualified investors to earn U.S. dollar yields paid out through blockchain technology, with the fund holding its assets in cash, U.S. Treasury bills, and repurchase agreements. Following BlackRock’s announcement, the tokenization of real-world assets (RWA) sector received increased attention, leading to outperformance this week.

- DOJ charges, CFTC enforcement action, lead to 15% outflows at Kucoin: KuCoin, one of the largest cryptocurrency exchanges, saw a 15% drop in the exchange's assets following news that the U.S. Department of Justice (DOJ) had charged KuCoin and two of its founders with violating U.S. Anti-Money Laundering (AML) laws. Also this week, the Commodity Futures Trading Commission (CFTC) also announced it filed a civil enforcement action against Kucoin.

- Merger news emerges among three of the biggest AI-related tokens in the space: On Wednesday, Bloomberg M&A announced that three of the biggest AI-related tokens in the space, SingularityNet, Fetch.ai, and Ocean Protocol, are in talks to merge their tokens into one single AltSignals (ASI) token in a bid to improve their efforts at developing a decentralized AI platform. Following the merger, the fully diluted value (FDV) would be ~$7.5B.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Spot BTC ETFs Reverse Outflow Streak, Pushing BTC Higher

Spot Bitcoin (BTC) ETFs have experienced a turnaround with $15.4M and $418.0M of across the first two days of this week, bringing an end to the five-day outflow streak we saw in the week prior. Fidelity’s ETF received the biggest inflows on Monday and Tuesday, outpacing BlackRock on both occasions.

The London Stock Exchange also that they plan to launch BTC and ETH ETNs by the end of May, signaling further ongoing interest in crypto-related products. These developments have helped to renew market optimism and push the price of BTC back above the $70K level, a +15% rise from the low of $61K only one week ago.

Launch of BlackRock’s BUIDL Pushes RWA Sector Higher

BlackRock signaled it is making another step into the digital asset space as it on Ethereum last week. The BlackRock USD Institutional Digital Liquidity Fund, called BUIDL, will allow qualified investors to earn U.S. dollar yields paid out through blockchain technology, with the fund holding its assets in cash, U.S. Treasury bills, and repurchase agreements.

According to the press release, “BUIDL seeks to offer a stable value of $1 per token and pays daily accrued dividends directly to investors' wallets as new tokens each month.” Following BlackRock’s announcement, the tokenization of real-world assets (RWA) sector has received increased attention and has led to , including Maple Finance (MPL) +60%, Realio (RIO) +200%, Swarm Markets (SMT) +135%, Clearpool (CPOOL) +100% over the past 7 days.

KuCoin Sees 15% Outflows On News of DOJ Charges

KuCoin, one of the largest cryptocurrency exchanges, following news that the U.S. Department of Justice (DOJ) had and two of its founders with violating U.S. Anti-Money laundering laws. The exchange has seen over $1.78B of outflows since the news broke which represents a according to The Block.

On Tuesday, the Commodity Futures Trading Commission (CFTC) it filed a civil enforcement action against Kucoin. One interesting point to note from the claim is that the CFTC classified Ethereum and Litecoin as commodities in the complaint, which contrasts the reports from earlier this month in which the U.S. Securities and Exchange Commission (SEC) is .

Potential Merger Reported Among Prominent AI Tokens

Artificial intelligence (AI) remains a prominent narrative across crypto. On Wednesday, that three of the biggest AI-related tokens in the space, SingularityNet, Fetch.ai, and Ocean Protocol, are in talks to merge their tokens into one single AltSignals (ASI) token in a bid to improve their efforts at developing a decentralized AI platform.

Following the merger, the fully diluted value (FDV) would be ~$7.5B. Bloomberg M&A has reported that although the three platforms will still operate as separate entities, reporting, “they would collaborate under the guidance of a so-called Superintelligence Collective run by Ben Goertzel, founder of SingularityNet.”

-From the Gemini Trading Desk

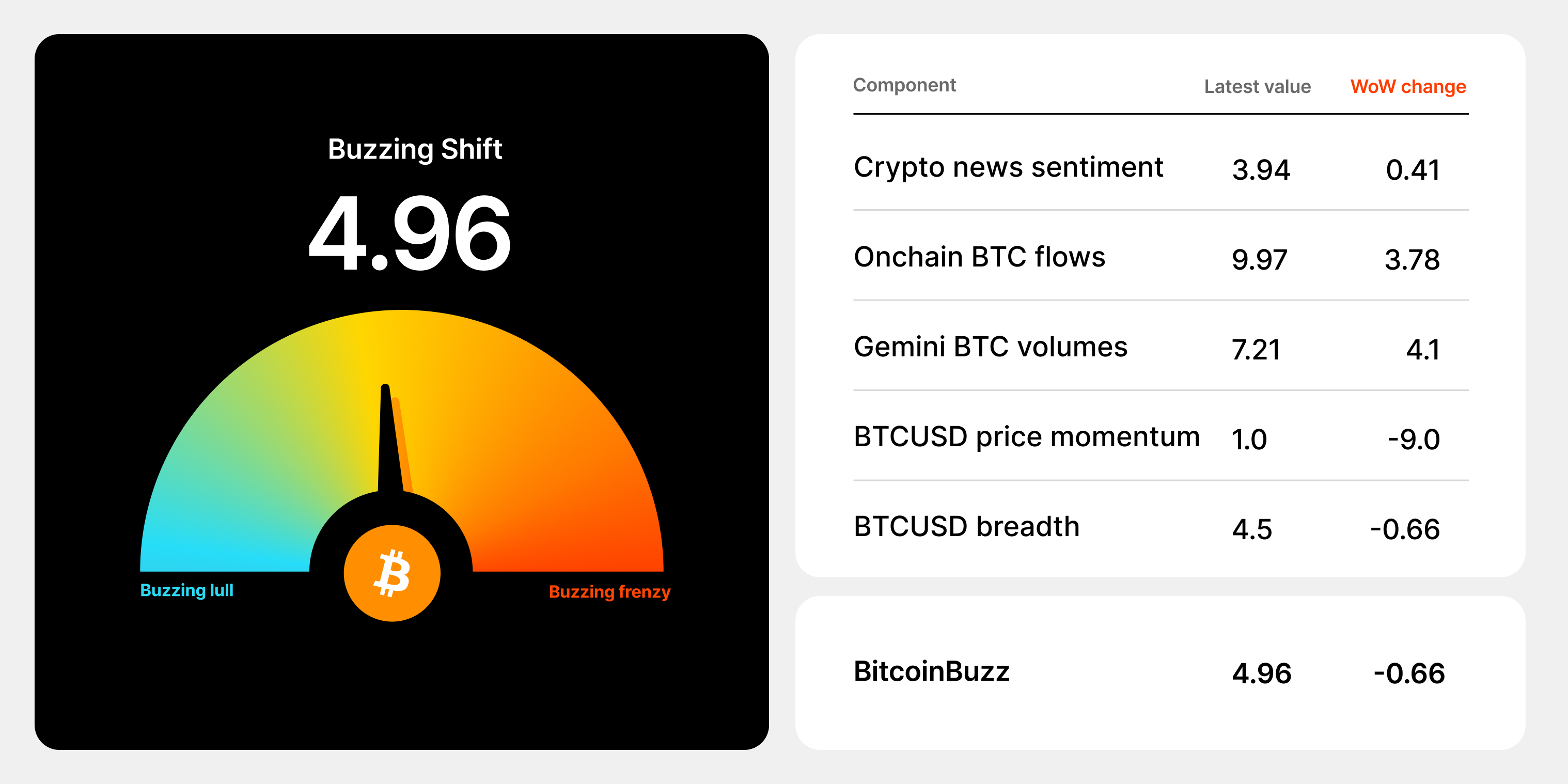

data as of 5:11pm ET on March 27, 2024.

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

What is MiCA? And why does it matter for crypto?

While many regulators globally have made strides toward regulating crypto in recent years, the European Union stands out both for its influence in traditional global markets and the quality and thoughtfulness of its approach.

In April 2023, EU lawmakers passed a vote to implement a piece of regulation — Markets in Crypto-Assets Regulation — which was hailed as the most significant crypto-specific regulation in the world to date. At a high level, the law states that crypto exchanges and custodian wallet providers must be licensed, and that token issuers must follow requirements for whitepapers, transparency, reserves, and disclosure as appropriate. Furthermore, MiCA aims to combat fraud and market manipulation, thereby safeguarding consumer interests.

By creating a standardized legal framework across the EU, MiCA not only increases the accountability of service providers but also fosters consumer confidence in using and investing in crypto-assets. This harmonization also facilitates easier access to cross-border services, ensuring EU consumers benefit from a diverse and competitive market.

The cost and effort associated with doing business in multiple jurisdictions can be prohibitive for those in the crypto industry, stifling innovation and blocking new players from participating. MiCA allows market participants to provide services to customers in 27 jurisdictions while complying with a single, streamlined set of regulations.

Consistent crypto regulations across the EU also benefit consumers. With multiple jurisdictions adhering to the same stringent regulations, companies are held to a consistently high standard and consumers will not be tasked with unpacking the nuances of various jurisdictions’ regulatory standards.

MiCA is also unique in its influence among global crypto regulatory regimes. The EU rules cover 16% of the global economy, setting an important precedent for countries like the UK and Singapore, both of which have been actively developing their own regulatory regimes.

In order for crypto to gain mainstream adoption, laws and regulations are an important step. If lawmakers in the EU and other jurisdictions globally did not see crypto playing a part in the financial ecosystem, they wouldn’t have brought MiCA and other regulations into play.

Onward and Upward, Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

DEC 19, 2025

Hyperliquid Is Now Available On Gemini

WEEKLY MARKET UPDATE

DEC 18, 2025

Visa Launches USDC Settlement Capabilities and Stablecoin Advisory Practice, XRP ETF Inflows Surpass $1B, and UK Treasury Makes Plans for Crypto Legislation

COMPANY

DEC 15, 2025