NOV 07, 2024

Crypto Prices Rally After US Election Results, Federal Reserve Cuts Rates

Welcome to our Weekly Market Update.* Explore weekly crypto price movements, read a quick digest of notable market news, and dive into a crypto topic — this week we learn more about Helium Network.

| Token | Change* | Price** | ||

|---|---|---|---|---|

Bitcoin

BTC | +8.16% | $76,184.25 |

$76,184.25

+8.16%

| |

Ether

ETH | +13% | $2,858.20 |

$2,858.20

+13%

| |

Aave

AAVE | +30.1% | $186.1992 |

$186.1992

+30.1%

| |

Lido DAO Token

LDO | +29.2% | $1.333 |

$1.333

+29.2%

| |

SuperRare

RARE | +23.8% | $0.124 |

$0.124

+23.8%

|

*Percentages reflect trends over the past seven days.

**Crypto prices as of Thursday, Nov. 7, 2024, at 1:00 pm ET. . All prices in USD.

Takeaways

- Donald Trump secured presidential win: The news is widely seen as a boon to the crypto space because of Trump’s pro-crypto policies. Bitcoin prices hit an all-time high.

- Solana reached a record 123 million active addresses in October, up over 42% from September: The network’s user engagement is now reportedly surpassing that of Ethereum by some measures.

- Spot bitcoin ETFs in the US reported $541 million in outflows on Monday, marking their largest daily decline since May: But they charged back on Wednesday to make up for the losses, pulling in more than $621 million.

- Lawyers for Binance and ex-CEO Changpeng Zhao have filed a motion to dismiss an amended SEC complaint: The motion argues that the SEC has failed to provide standards for defining crypto securities.

- Mt. Gox transferred roughly $2.19 billion worth of BTC to unknown wallets on Monday: The move follows a recent repayment delay announcement, with creditors still awaiting funds from the exchange’s 2014 collapse.

Sign up for a Gemini account

The secure way to buy, sell, store and convert crypto. Millions use Gemini to diversify their portfolios.

Trump Wins Presidency After Securing Every Swing State

The win is widely seen as a positive for the crypto ecosystem. Over the past few months, Trump has pledged his support for digital assets. In July, he spoke at the Bitcoin Conference in Nashville, promising to set up a national strategic bitcoin reserve and to fire SEC chair Gary Gensler, who has filed numerous lawsuits against a range of cryptocurrency exchanges. Additionally, Trump recently launched World Liberty Financial, a DeFi company that plans to sell $30 million in tokens.

Meanwhile, Harris never took an official policy stance on regulating crypto. And as vice president, the Biden administration largely had a hawkish stance against crypto companies, with Gensler taking a regulation by litigation approach that largely alienated an asset class that has become increasingly entrenched within traditional finance.

The price of bitcoin hit an all-time high this week, surging to more than $76,500 by Thursday afternoon.

Solana Hits Record 123M Monthly Active Addresses Amid Memecoin Boom

Analysts have attributed the growth to the popularity of memecoin trading, spurred by platforms like the token creation app Pump.fun.

Some industry reports have also been highlighting Solana’s rising engagement levels, noting there are over 100 million active addresses compared to Ethereum’s 57 million. Additionally, the rise of AI-linked memecoins have reportedly led to this increased activity.

With Solana designed as a lower-cost network in comparison to other smart contract compatible chains, this may be playing a role in increased engagement as well, as innovators have difficulty accepting comparatively expensive Ethereum gas prices.

US Spot Bitcoin ETFs Experience $541M Outflows On Monday, Then Bounce Back

This shift comes after an inflow surge last week, when ETFs attracted approximately $2.22 billion.

Eight of the spot bitcoin ETFs recorded outflows, with Fidelity’s FBTC seeing the largest drawdown at $169.6 million. Ark & 21Shares’ ARKB lost $138.26 million, while Bitwise’s BITB reported outflows of $79.84 million. Grayscale’s GBTC and Mini Bitcoin Trust followed with $63.66 million and $89.49 million in net outflows, respectively.

Overall, net inflows for US spot bitcoin ETFs have now exceeded $24 billion.

Binance and CZ’s Lawyers File Motion to Dismiss SEC's Amended Complaint

The legal team argues that the SEC lacks regulatory clarity regarding which crypto transactions qualify as securities.

The filing alleges the SEC’s amended complaint “refuses to accept” that secondary market resales of crypto assets, particularly in the open market, do not equate to securities transactions. Instead, it accuses the SEC of asserting that nearly all crypto transactions, even those in secondary markets, qualify as securities. The lawyers further pointed out that the SEC has inconsistently classified crypto assets, recently dropping its assertion that transactions involving ETH are investment contracts without explanation.

The regulator filed its initial suit in June 2023 against Zhao and affiliated companies. This civil case is separate from criminal charges that Binance and Zhao faced from the Department of Justice. In November 2023, Binance admitted to AML and sanctions violations, paying a $4.3 billion fine, with Zhao serving four months in a US prison.

Mt. Gox Transfers 32,371 BTC to Unmarked Wallets Amid Repayment Delays

Notably, 2,000 BTC was initially sent to a Mt. Gox cold wallet, before being transferred again to an unmarked address.

This movement, which occurred on Monday, marks the largest transfer from Mt. Gox in months and comes on the heels of a smaller 500 bitcoin transaction to unmarked wallets just a few days prior. It is still uncertain whether this transfer is part of the exchange’s ongoing repayments to creditors affected by its 2014 bankruptcy.

The exchange has already announced an extension of one year on its repayment deadline, moving it from Oct. 31, 2024, to Oct. 31, 2025. Some analysts have noticed that such repayment transfers tend to contribute to BTC selling pressure. Thousands of creditors have been eagerly anticipating their repayments, but the process is proving to be extremely lengthy.

-The Gemini Team

data as of 5:13 pm ET on Nov. 6, 2024.

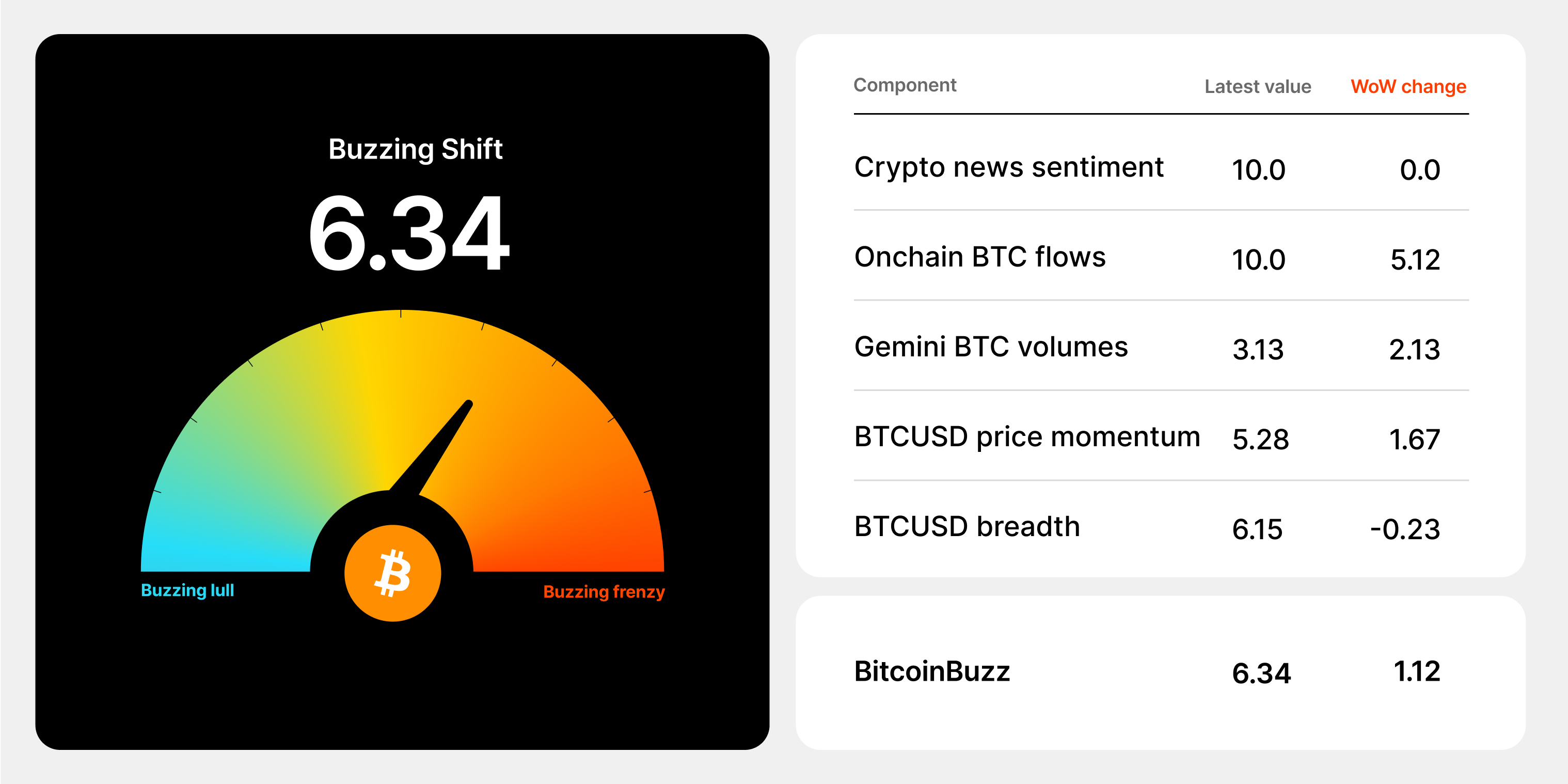

To learn more about the BitcoinBuzz Indicator and its components, . Check back every week for an updated score!

Helium Network (HNT): Decentralizing Wireless Networks

Helium is a blockchain network that leverages a decentralized global network of Hotspots — devices that double as network miners and wireless access points — initially to provide long-range connectivity to Internet of Things (IoT) devices, and long-term to connect anything to the internet via a decentralized wireless network such as 5G. Hotspots can be deployed by anyone and enable individuals to earn Helium’s native HNT coins in exchange for providing devices with connectivity. This decentralized, blockchain-based approach allows wireless infrastructure to scale more rapidly and at a fraction of the cost of traditional models.

Onward and Upward,

Team Gemini

*This material is for informational purposes only and is not (i) an offer, or solicitation of an offer, to invest in, or to buy or sell, any interests or shares, or to participate in any investment or trading strategy, (ii) intended to provide accounting, legal, or tax advice, or investment recommendations, or (iii) an official statement of Gemini. Gemini, its affiliates and its employees do not make any representation or warranty, expressed or implied, as to accuracy or completeness of the information or any other information transmitted or made available. Buying, selling, and trading cryptocurrency involves risks, including the risk of losing all of the invested amount. Recipients should consult their advisors before making any investment decision. Any use, review, retransmission, distribution, or reproduction of these materials, in whole or in part, is strictly prohibited in any form without the express written approval of Gemini.

RELATED ARTICLES

COMPANY

DEC 19, 2025

Hyperliquid Is Now Available On Gemini

WEEKLY MARKET UPDATE

DEC 18, 2025

Visa Launches USDC Settlement Capabilities and Stablecoin Advisory Practice, XRP ETF Inflows Surpass $1B, and UK Treasury Makes Plans for Crypto Legislation

COMPANY

DEC 15, 2025