JUL 26, 2023

Gemini Webinar Recap: Exploring Stablecoin Risk Management and Diversification

The collapse of Terra in 2022, the fall of Silicon Valley Bank earlier this year, and the accompanying USDC depegging event have raised critical questions about stablecoins and associated risks. How can investors diversify their stablecoin holdings to mitigate counterparty risk, what types of infrastructure solutions for stablecoin redemption and creation are required to satisfy extreme volumes?

Claire Ching, Gemini’s Head of Institutional, and Kevin Yedid-Botton, Partner at ParaFi Capital, dove into these questions and more during a recent Gemini Webinar.

Watch the Full Webinar

Claire Ching and Kevin Yedid-Botton discuss stablecoin risk management, diversification, and more.

They explored stablecoin risk management, discussed why stablecoin diversification is critical for players in the crypto space, and demystified the range of components underlying these types of crypto tokens, ultimately shedding light on the dynamic stablecoin landscape.

Below, we tease out three salient takeaways from the conversation between Claire and Kevin.

Diversification Can Protect Against the Unexpected

Despite the variety of dollar-based stablecoins, including , , and , diversification is central to a sound stablecoin portfolio. A main differentiator between dollar-based stablecoins is their reserve backing composition, with treasury management teams for each issuer using varied approaches to ensure the token’s 1-to-1 backing.

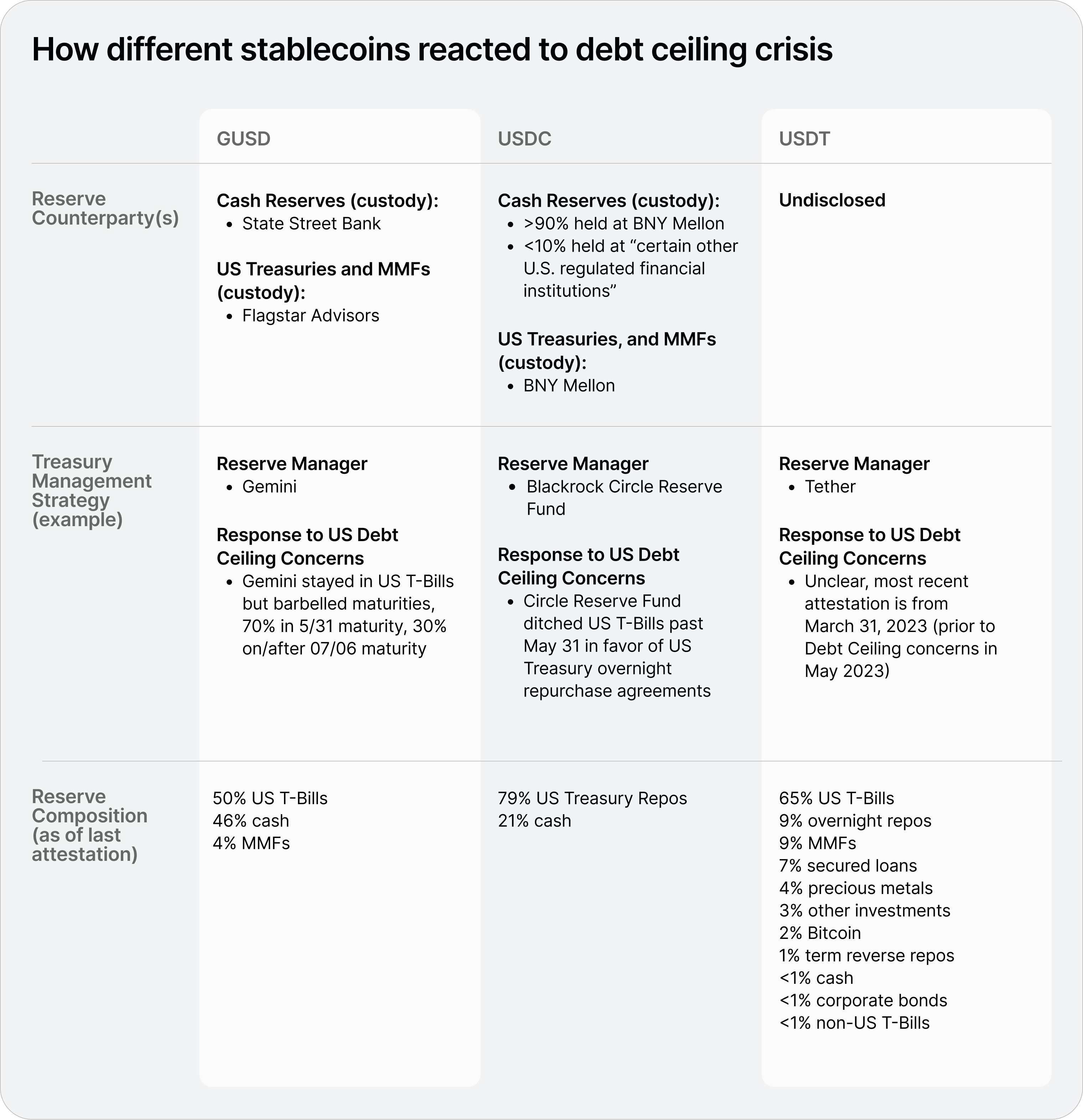

To highlight the importance of diversification, Claire and Kevin discussed an example from June when the U.S. government was edging closer to its debt ceiling, and was struggling to get the votes in Congress to raise it. Some stablecoin issuers hold a large amount of their reserves in short-term U.S. treasuries. With the looming risk of U.S. debt default, these issuers made adjustments to their collateral reserve strategy in an effort to mitigate any potential fallout.

Circle, the company behind USDC, publicly shifted a large portion of its stablecoin reserves away from those short-term treasuries into overnight repurchase agreements (another type of short-term loan used by treasury traders).

Gemini took a different approach to backing GUSD, known as a barbell approach. We adjusted our treasury holdings to avoid maturity dates during the period that a potential government default could occur (with most treasuries maturing before and after that period, hence “barbell"), reducing exposure to the debt ceiling standoff.

Overall, Tether has a separate strategy. While it holds a large portion of its USDT reserves in treasuries, it also includes allocations to precious metals, bitcoin, secured loans, and other investments.

The chart below outlines where these different stablecoin issuers hold their reserves, how they responded to the debt ceiling crisis, and what their reserves looked like as of May 31, 2023 (GUSD and USDC) or as of March 31, 2023 (USDT).

Sources: , , , and . (Percentages rounded to the nearest whole number)

These differences in underlying compositions raise important questions. How well do investors understand the composition of stablecoins? Do they fully grasp an issuer’s treasury management strategies and how reserves are managed? Treasury strategies are crucial for an issuer to effectively redeem stablecoins as needed, particularly during times of crisis.

Ensuring Seamless and Reliable Creation and Redemption

Ultimately, the seamless creation and redemption of stablecoins should be the primary concern for any stablecoin issuer. Some issuers do that better than others. GUSD, for example, can be created and redeemed on Gemini in a few steps, all you need is a Gemini account. Similarly, USDC, can be created and redeemed through Coinbase and Circle.

In the case of USDT, the average person lacks direct access to the creation or redemptions levers. Instead, they are reliant on the secondary market, which can lead to significant swings in the value of USDT (not preferable given that these tokens are meant to remain “stable”).

As Silicon Valley Bank collapsed, USDC’s exposure to the bank raised concerns and the token traded as low as $0.88 USD during that fraught weekend. As arbitrageurs sold USDC for USDT, the price of USDT rose nearly 10% on some exchanges, and didn’t fall back to $1 USD for some time as few individuals have an easily accessible venue to redeem their USDT for dollars.

This year’s banking crisis highlighted the importance of not only having access to multiple market venues for trading stablecoins, but also the need for institutions to diversify their avenues for creating and redeeming stablecoins.

Understanding the Components Underlying Stablecoins

When evaluating dollar-backed stablecoin risks, investors should consider not just the token itself, but also multiple layers of underlying technology and financial infrastructure. The bedrock is the U.S. government, since dollar-backed stablecoins are ultimately U.S.-based and track the value of the dollar.

.

There are other elements to consider, too. Banking institutions, trust companies, insurance, blockchain networks, and smart contracts all come into play as other important components to evaluate when assessing a stablecoin. These components create a nested layering of financial and technological infrastructure that must come together seamlessly for the efficient functioning of stablecoins.

The variation in these components shows that all stablecoins are not created equal, and highlights how stablecoin diversification can help investors more effectively manage risk.

.

Last month’s with Claire and Kevin set the stage for a greater understanding of stablecoins and the considerations investors should keep in mind. Keep an eye out for more Gemini webinars that will explore important questions in crypto and blockchain.

Onward and Upward!

Team Gemini

RELATED ARTICLES

COMPANY

DEC 15, 2025

Gemini Predictions™ Is Now Live

WEEKLY MARKET UPDATE

DEC 11, 2025

Federal Reserve Cuts Rates Again, SEC Proposes New Token Guidelines, and BlackRock Applies for Ether Staking ETF

COMPANY

DEC 10, 2025