JAN 22, 2025

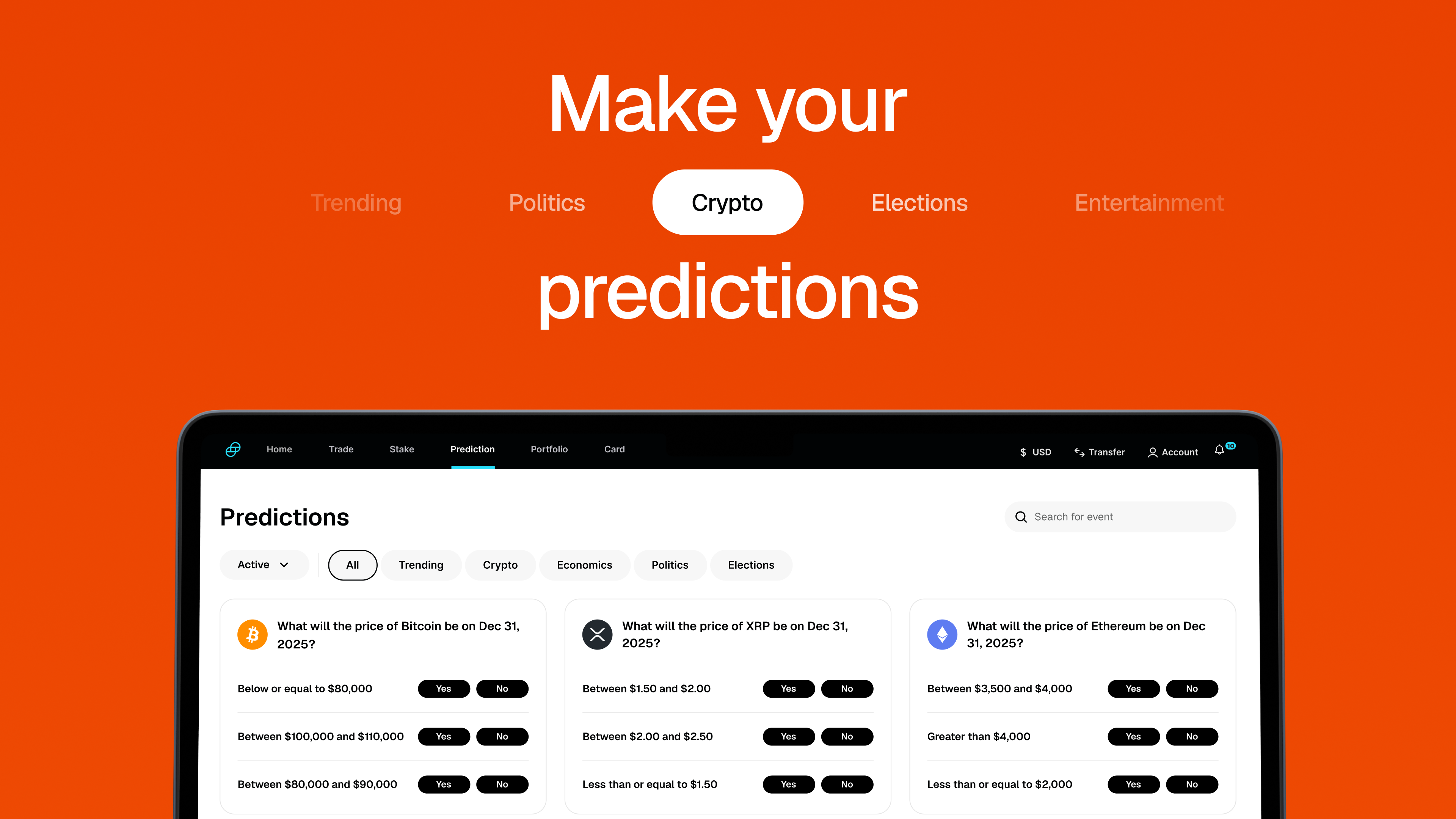

Five Crypto Predictions for 2025

The cryptocurrency industry changed forever in 2024.

Spot bitcoin ETFs launched in the United States in January, bringing billions in institutional inflows. The latest Bitcoin halving event hit in April, cutting in half the available rewards miners receive when they mint a new bitcoin. And in the US election in November, Republicans won the Presidency and both chambers of Congress while promising to usher in a new pro-crypto regulatory environment.

As we enter 2025, crypto bulls are buoyant after surviving the crypto winter, an aggressive regulatory enforcement regime, and a cascade of negative media attention from the fallout of FTX.

With optimism around digital assets approaching an all-time high, we felt it was the right time to offer five predictions for the crypto industry in 2025:

Prediction 1: Bitcoin Will Continue Its Hot Streak

Bitcoin is poised to have another banner year in 2025.

After launching in January, spot bitcoin ETFs became the fastest growing exchange-traded fund ever created in the US, proving that retail and institutional investors were eager to gain exposure to bitcoin’s price movements.

A year later, demand for spot bitcoin ETFs has been relentless, with inflows of $2 billion during one particularly bullish week in December.

Corporate adoption of bitcoin is also likely to help the rally continue. Over the past year-plus, Microstrategy founder Michael Saylor has turned his software company into a pseudo bitcoin treasury. The details will make your head hurt when you hear him explain it, but it involves Saylor issuing convertible notes to debt holders so he can buy more bitcoin.

The sustained buying has no doubt helped bitcoin’s price climb higher. It’s also inspired more large-scale public companies to purchase bitcoin and make it their own reserve asset.

Expect more corporations to use bitcoin as a reserve asset in 2025.

Prediction 2: The US Will Launch A Bitcoin Reserve

During an appearance at the annual Bitcoin Conference over the summer, president-elect Donald Trump said he would create a strategic bitcoin reserve when he takes office. Here’s to thinking he will deliver on that promise.

Senator Cynthia Lummis (R-WY) has already proposed legislation that would instruct the US Treasury to purchase $200,000 bitcoin annually over the next five years. Such a program would likely supercharge demand for the world’s largest digital asset, driving the price higher.

In December, Federal Reserve chairman Jerome Powell indicated that the Fed is not attempting to change the law so it can hold bitcoin, noting it was not allowed to own it under current laws.

"That's the kind of thing for Congress to consider, but we are not looking for a law change at the Fed," he said.

Indeed, it will take action from Congress for the Fed to create an official strategic reserve for Bitcoin. Don’t be surprised if lawmakers will do just that before 2025 comes to a close.

Prediction 3: Congress Will Pass a Digital Assets Bill

In 2024, the US House of Representatives passed FIT21, a bipartisan bill offering a comprehensive framework outlining how multiple US agencies would regulate the digital assets industry. Despite support from US Senate leader Chuck Schumer (D-NY) and a range of other Democrats, the bill stalled in the upper chamber of Congress.

Lawmakers expect to introduce FIT21 in 2025, and the environment looks promising. Trump has pledged to make the United States the “crypto capital of the planet.” And Republicans now control both chambers of Congress, which should make the bill easier to pass.

In the meantime, look for Congress to pass stablecoin regulation, long considered a layup for lawmakers. This past fall, Patrick McHenry (R-NC) and Maxine Waters (D-MO) reached a bipartisan stablecoin deal but apparently ran out of time to close it before the end of their 2024 lame-duck session. The good news: Congress is expected to re-introduce the stablecoin bill when it reconvenes in 2025

Prediction 4: Tokenization Will Go Mainstream

The World Economic Forum in Davos has long been a meeting place for the political and financial elite. The annual event in Davos, Switzerland includes a series of panels where market movers discuss a range of topics, the vast majority of which revolve around tradfi.

This past year, the discussion turned to blockchain tokenization, signaling that a previously niche part of the crypto world has become a major initiative for institutional investors.

Why? Tokenization has an ironclad business case for capital markets.

Tokenization involves taking a real-world asset such as real estate and “tokenizing it” so it can be sold on the blockchain.

“The need for shortened settlement cycles – which improve liquidity, enhance market efficiency and lower systemic risk – and the demand for 24/7 market operations will require a new infrastructural backbone,” per the WEF report.

Franklin Templeton and Blackrock have introduced tokenized mutual funds. Expect more financial institutions to soon follow suit as they aim to unlock $255 trillion in marketable securities that can be used as collateral.

Prediction 5: More Crypto ETFs Are on the Way

Expect spot ETFs for XRP and Solana to start trading in the US in 2025.

In October, Bitwise filed for a spot XRP ETF, hoping to capitalize on the unprecedented interest in spot bitcoin and spot ethereum ETFs. Crypto betting site Polymarket had the percentage of XRP ETF approval at 70%, indicating bullish sentiment among retail investors.

The SEC recently filed an appeal in its lawsuit against Ripple after a lower court judge ruled against the regulatory agency. But that case appears destined to fizzle with a new regime ready to take the reins. SEC chair Gary Gensler is expected to step down later this month, with crypto advocate Paul Atkins slated to replace him.

Meanwhile, has experienced a rapid ascent recently, rising 107% over the past year as memecoins surged in popularity. As of Friday, Polymarket put the percentage of SEC approval of spot Solana ETF at 77%. That marks a fairly encouraging sign after a Gensler-led SEC told two of the five applicants for a Solana ETF in December that the filing was delayed indefinitely.

Additionally, analysts expect the SEC to approve a combo bitcoin-ethereum ETF, which weighs the prices of both digital currencies, along with a handful of other crypto-focused ETFs.

RELATED ARTICLES

COMPANY

DEC 19, 2025

Hyperliquid Is Now Available On Gemini

WEEKLY MARKET UPDATE

DEC 18, 2025

Visa Launches USDC Settlement Capabilities and Stablecoin Advisory Practice, XRP ETF Inflows Surpass $1B, and UK Treasury Makes Plans for Crypto Legislation

COMPANY

DEC 15, 2025