AUG 07, 2023

Gemini Foundation Academy: Profit, Loss, and Funding Payments

When trading perpetual contracts (perps), we can expect to face losses on bad days, but every trader’s goal is to increase the amount of profitable days. As such, it’s important to understand the different types of profit and loss (P&L), how they are derived, and how funding payments play into the equation. Let’s dive in!

Realized vs. Unrealized P&L

There are two basic types of P&L: Realized and Unrealized. The conceptual difference is pretty simple.

Realized P&L is profit or loss that is finalized after closing a position, fully or partially. It is based on the difference between the average entry price and exit price of a position, including any fees or funding payments. Realized P&L remains static, only changing after a position is closed or reduced.

Unrealized P&L is essentially the profit or loss that would become realized if the position were closed. It is calculated as the difference between the mark price and the average entry price. Unrealized P&L changes as the mark price changes, constantly going up or down with the market and is included in your margin calculations.

Profit Example - (two entries then close)

Let’s walk through an example. We start by opening a long 10 BTCGUSD Perp position at a price of $30,000. As soon as we open the position and before the market moves, our unrealized and realized P&L are at $0.

Unrealized P&L (buy) = Quantity x (Mark Price - Avg. Entry Price) Unrealized P&L (sell) = Quantity x (Avg. Entry Price - Mark Price)

Plugging the numbers into the buy equation we can see that -

Unrealized P&L = 10 x ($30,000 - $30,000) = 10 x ($0) = $0

Now suppose that after an hour, BTCGUSD Perp has increased to $30,500. Our unrealized profit can be calculated using the same equation -

Unrealized P&L = Quantity x (Mark Price - Avg. Entry Price)

Plugging in the numbers -

Unrealized P&L = 10 x ($30,500 - $30,000) = 10 x ($500) = $5,000

We then decide to add to the position and buy 10 more BTCGUSD Perp at $30,500. Although our average entry price has changed -

Avg. Entry Price = [(Quantity1 x Entry Price1) + (Quantity2 x Entry Price2)] / (Quantity1 + Quantity2) = [(10 x $30,000) + (10 x $30,500)] / (10 + 10) = ($300,000 + $305,000) / 20 = $605,000 / 20 = $30,250

Our unrealized profit does not change -

Unrealized P&L = Quantity x (Mark Price - Avg. Entry Price) = 20 x ($30,500 - $30,250) = 20 x $250 = $5,000

Now suppose again that the price of BTCGUSD Perp further increases to $31,000. Our unrealized profit increases even more now that we have doubled our position size -

Unrealized P&L = Quantity x (Mark Price - Avg. Entry Price) = 20 x ($31,000 - $30,250) = 20 x $750 = $15,000

Finally, we close our position at $31,000, converting our unrealized profit of $15,000 into realized profit.

Index Price, Perp Price, Mark Price

The value of a perpetual futures contract is directly related to the Index Price of the underlying spot instrument. To calculate the Index Price of a perp, the fair market spot price is taken into account from various major spot exchanges. This approach prevents market manipulation or excessive volatility stemming from a single exchange.

When trading a perpetual futures contract, you will encounter the Perp Price, which is the price at which the contract is bought or sold. This price plays a significant role in determining your average price when opening or adding to positions.

To ensure a fair representation of the perpetual contract’s value, we have the Mark Price. This price is typically derived from the Index Price and the Perp Price. The Mark Price is often averaged over a recent time period to account for temporary market fluctuations. This essential metric is used in calculating your unrealised P&L, and also comes into play when determining if a position needs to be liquidated.

Funding Payment

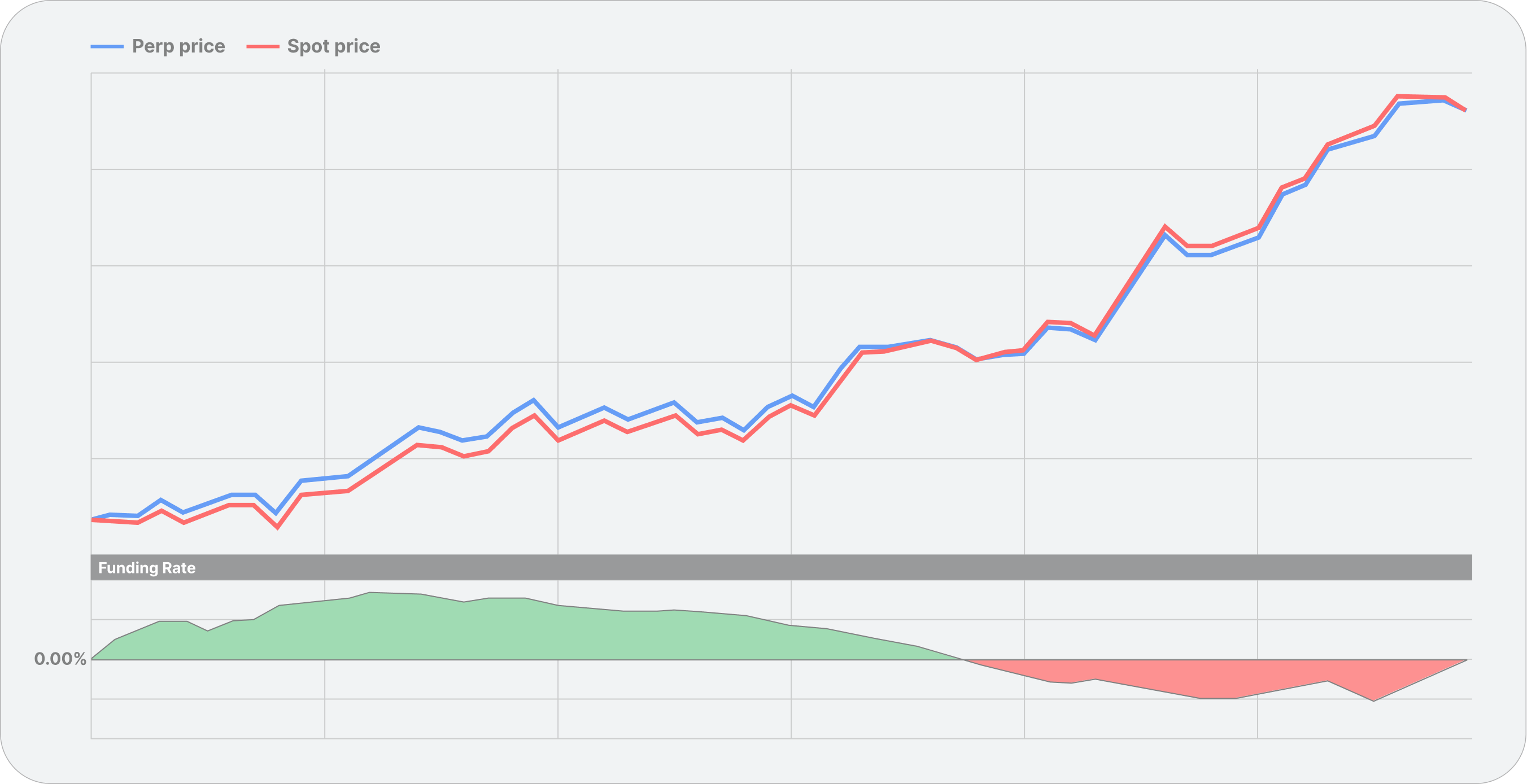

What keeps the Perp Price and Spot Price in sync? That’s where the Funding Payment comes in.

Conventional futures will trade at a price that is different from the spot price. One of the key determinants for this price difference is the period of time until the future expires. Perpetual contracts, however, have no expiry date. Therefore, unlike dated futures that do expire, there is no definitive point in time when the perpetual and the spot price will be at the same price.

To ensure that there isn’t significant divergence between the perpetual and the underlying spot price, funding payments are made. These are automatic payments made specifically between the long holders and short holders of perpetuals, not to or from the exchange.

Funding payments are made at set intervals defined by the exchange, usually ranging between 1-12 hours. At each interval the payment is a function of the difference in price between the perpetual price and the spot price during the time period between the payment intervals. If the perpetual price is higher than the spot price then long holders pay short holders an amount based on this premium. If the perpetual price is lower than the spot price, then long holders receive an amount from short holders based on this discount.

The concept of the funding payment is to incentivise short holders as the premium to spot gets bigger, thus capping or reducing this premium, or to incentivize long holders as the discount gets bigger, similarly capping or reducing this discount. This funding payment is made in the settlement currency of the contract and is paid/received immediately following the end of each funding period. The net effect is to keep the spot and perpetual prices together, despite not having an expiry date that would force them to be equal.

Funding Payment Calculations

Funding Payment amounts are either provided to you by the exchange or can be calculated by multiplying the Funding Rate by the notional value of the position.

My Funding Payment = Funding Rate x Notional Value of My Position

If Funding Payment is provided, it is usually on a per contract basis. To determine the funding payment on your position, simply multiply by the number of contracts you are long or short.

My Funding Payment = Funding Payment x Quantity of My Position

Finally, I need to determine whether I am receiving or paying. If the funding payment/rate is positive, long positions pay short positions. If the funding payment/rate is negative, short positions pay long positions.

Positive = Long → Short

Negative = Short → Long

At Gemini, we want to give you all the tools to effectively trade on our platform. Understanding these concepts is crucial to being a successful derivatives trader, so we encourage you to take the time to explore these topics!

This series is more than just a learning resource — it's an invitation to join Gemini’s thriving community of traders and crypto enthusiasts. We encourage active participation, open dialogue, and knowledge exchange to further enhance your learning experience.

We have plenty more resources planned, so stay tuned to our blog!

Onward and Upward,

The Gemini Foundation Team

Disclaimer

Cryptocurrency derivatives are complex products that are not suitable for all investors. You should participate in trading crypto derivatives at your own risk and only after doing your own research and understanding the function, terms, and conditions of these products. With leveraged derivatives, you may lose part or all of your investment even if there is only a small fluctuation to the index price.

RELATED ARTICLES

COMPANY

DEC 19, 2025

Hyperliquid Is Now Available On Gemini

WEEKLY MARKET UPDATE

DEC 18, 2025

Visa Launches USDC Settlement Capabilities and Stablecoin Advisory Practice, XRP ETF Inflows Surpass $1B, and UK Treasury Makes Plans for Crypto Legislation

COMPANY

DEC 15, 2025