APR 06, 2022

The Gemini Credit Card: Building a Credit Card for the Future

Blockchain and crypto continue to challenge the way we think about money and the transfer of value in the digital age. At Gemini, we believe these new technologies will unlock a new era of financial, creative, and personal freedom, and we want to take you along for the ride.

In line with that mission, we partnered with Mastercard and WebBank to build the , bridging the gap between the familiar act of swiping a card and the promise of crypto. The extensive collaboration within Gemini, and with our partners, allowed us to create a one-of-a-kind card that unifies crypto with the traditional financial system.

A Seamless Way to Introduce Crypto to All

Even if your opinions about crypto aren’t fully formed, or you feel like you don’t know enough to jump in head-first, the Gemini Credit Card offers you the opportunity to seamlessly earn crypto on everyday purchases.

We’ve already started ,1 and it will be available to the general public in the near future. The card is available to eligible individuals in all 50 states and Washington D.C. Once approved, card holders can earn 3% crypto back on dining,2 2% crypto back on groceries, and 1% crypto back on all other purchases.

The Four Stages of Developing the Gemini Credit Card

We built the Gemini Credit Card with security and simplicity as our guiding principles. And, while security is always top-of-mind at Gemini, the process of ideating, engineering, and actually building the card was anything but simple.

It took dozens of engineers, product managers, operations experts, and more to build a card that brings the world of credit cards to the future.

- Stage 1: Building a bridge to the world of crypto. In contrast to debit cards that allow customers to spend their own crypto, we wanted to create a simple and comfortable way to introduce customers to crypto without changing their day-to-day behavior. With that goal in mind, the Gemini Credit Card was born, allowing customers to spend fiat and receive crypto rewards.

- Stage 2: Collaborating with the right partners. Building a credit card from scratch, let alone a crypto credit card, requires multidisciplinary teams to work together with a shared vision. We are thrilled to have to develop the Gemini Credit Card.

- Stage 3: Offering unique features and rewards. We set out to build the first credit card where customers can receive instant rewards in crypto the moment they use their card.3 Customers can choose to receive their rewards in 60+ cryptos available for the Gemini Credit Card, and can switch rewards at any time.

- Stage 4: Security-first design. At Gemini, trust is our product, and security is a central pillar in every product we build. The Gemini Credit Card reflects this mindset. We chose a high-quality stainless steel card and removed the card number from the card itself, instead providing users with access to all relevant information on the App. Beyond these security features, customers also benefit from Mastercard’s Zero Liability Protection and ID Theft Protection.

We are thrilled to bring the Gemini Credit Card to market and support the expansion of the crypto industry as we harness the promise of Web3.

Onward and Upward!

Team Gemini

1 Issued by WebBank. A Gemini Mastercard®.

2 Up to $6,000 in annual spend, then 1% back on everything else.

3 .

RELATED ARTICLES

COMPANY

DEC 15, 2025

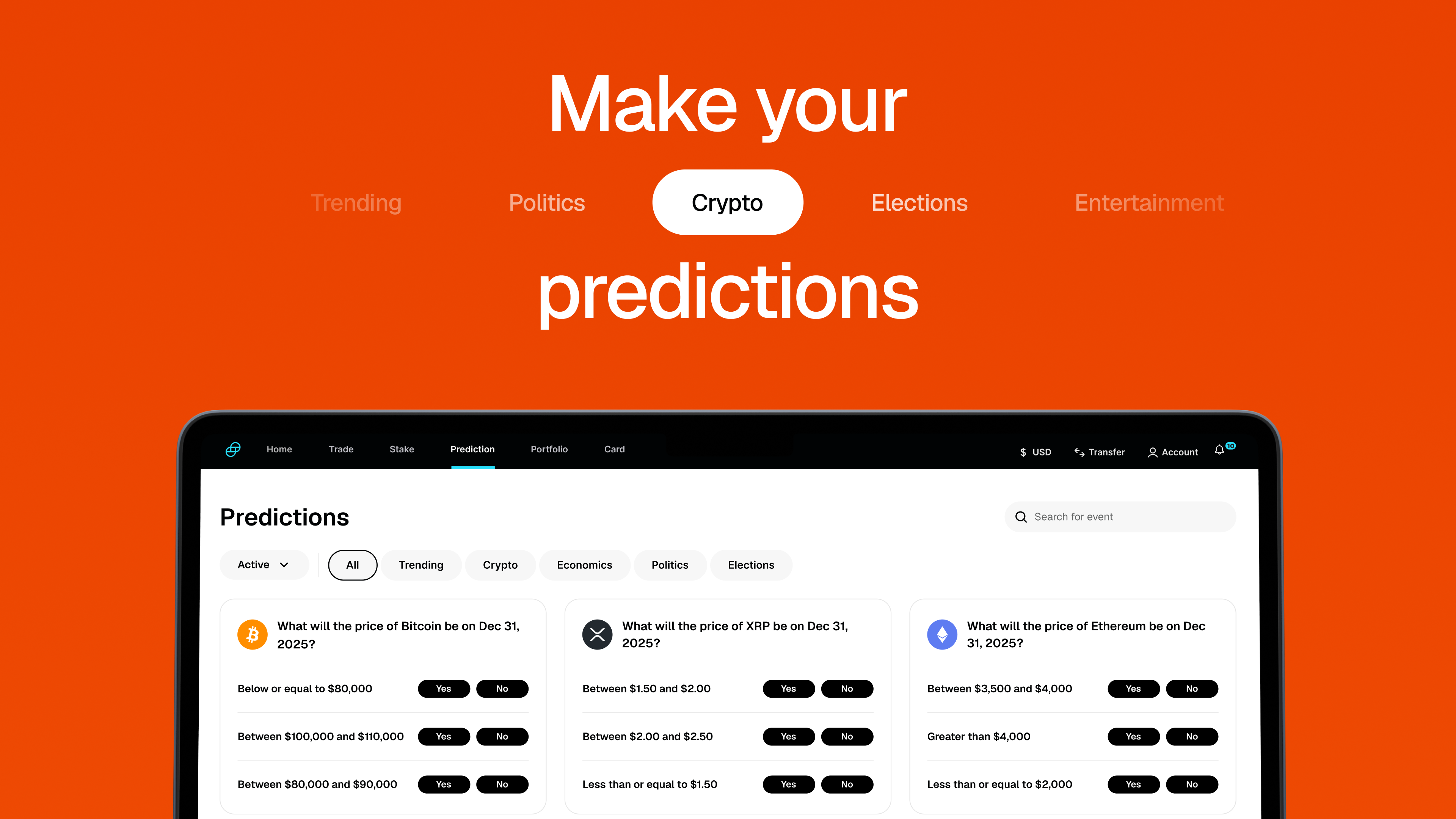

Gemini Predictions™ Is Now Live

WEEKLY MARKET UPDATE

DEC 11, 2025

Federal Reserve Cuts Rates Again, SEC Proposes New Token Guidelines, and BlackRock Applies for Ether Staking ETF

COMPANY

DEC 10, 2025