The Gemini Credit Card®

The Card of the Future

Earn up to 4% crypto back on every

purchase with no annual fee

Get started

Gas, EV & Transit

4%

Dining

3%

Groceries

2%

Everything else

1%

Issued by WebBank. See for more information regarding rates, fees, and other cost information.

Go Further with Every Swipe

Mastercard® World Elite

Learn more about

No annual fee

No foreign transaction fees

Mastercard® World Elite

Learn more about

No annual fee

No foreign transaction fees

Crypto Rewards Move Faster

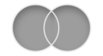

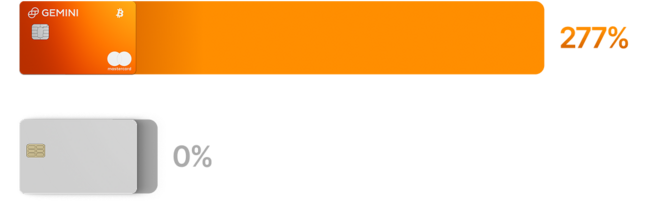

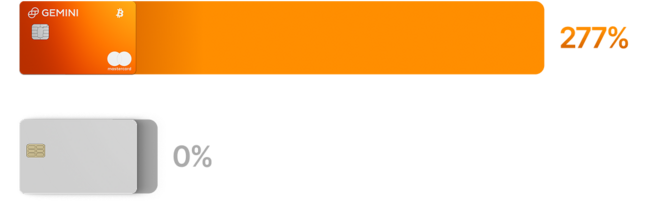

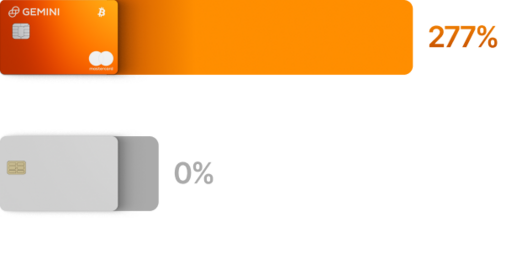

Bitcoin is an Investment. Points aren't.

Bitcoin rewards earned on The Gemini Credit Card® and held for at least 1 year have appreciated an average of 277%

Analysis reflects Gemini Credit Card holders who earned bitcoin rewards between 10/08/2021 and 7/27/2024 and held all such rewards in their Gemini account through 07/27/2025. Calculation is based on bitcoin market value changes during the holding period. Individual results will vary depending on spend behavior, chosen rewards currency, holding duration, and market performance. Past performance is not indicative of future results. This information is for general informational purposes only and does not constitute investment advice.

Bitcoin is an Investment. Points aren't.

Bitcoin rewards earned on The Gemini Credit Card® and held for at least 1 year have appreciated an average of 277%

Analysis reflects Gemini Credit Card holders who earned bitcoin rewards between 10/08/2021 and 7/27/2024 and held all such rewards in their Gemini account through 07/27/2025. Calculation is based on bitcoin market value changes during the holding period. Individual results will vary depending on spend behavior, chosen rewards currency, holding duration, and market performance. Past performance is not indicative of future results. This information is for general informational purposes only and does not constitute investment advice.

Bitcoin is an Investment. Points aren't.

Bitcoin rewards earned on The Gemini Credit Card® and held for at least 1 year have appreciated an average of 277%

Analysis reflects Gemini Credit Card holders who earned bitcoin rewards between 10/08/2021 and 7/27/2024 and held all such rewards in their Gemini account through 07/27/2025. Calculation is based on bitcoin market value changes during the holding period. Individual results will vary depending on spend behavior, chosen rewards currency, holding duration, and market performance. Past performance is not indicative of future results. This information is for general informational purposes only and does not constitute investment advice.

Earn bitcoin or 50+ cryptos

Easily change the crypto you want to earn, as often as you want.

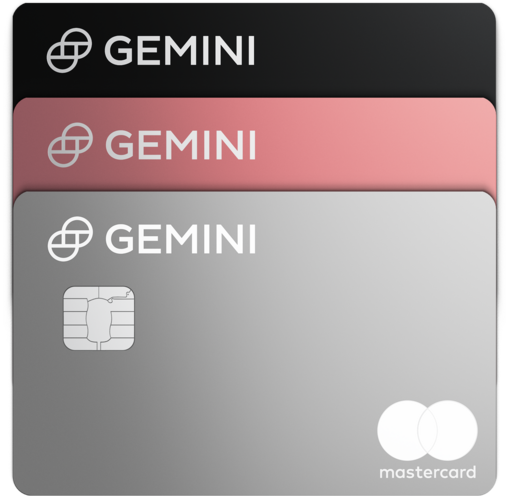

Same Benefits,

Sleek New Designs

The Solana Edition

The XRP Edition

The Bitcoin Credit Card™

Earn up to 4% on every purchase1

Earn bitcoin, or 50+ cryptos available on Gemini

Rewards are instantly deposited2

The Gemini Credit Card®

Earn up to 4% on every purchase1

Earn bitcoin, or 50+ cryptos available on Gemini

Rewards are instantly deposited2

Earn bitcoin or 50+ cryptos

Easily change the crypto you want to earn, as often as you want.

Same Benefits, Sleek New Designs

The Gemini Credit Card®

The Solana Edition

The XRP Edition

The Bitcoin Credit Card™

Earn up to 4% on every purchase1

Earn bitcoin, or 50+ cryptos

available on Gemini

Rewards are instantly deposited2

Earn bitcoin or 50+ cryptos

Easily change the crypto you want to earn, as often as you want.

Same Benefits, Sleek New Designs

The Gemini Credit Card®

The Solana Edition

The XRP Edition

The Bitcoin Credit Card™

Earn up to 4% on every purchase1

Earn bitcoin, or 50+ cryptos

available on Gemini

Rewards are instantly deposited2

Take Full Control of Your Finances

Seamlessly integrate the card with popular budgeting apps.

Earn 10% Back

on the Internet’s

Favorite Brands.3

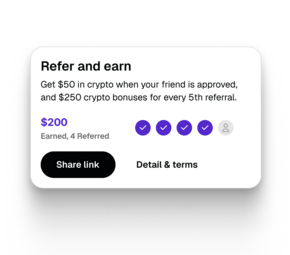

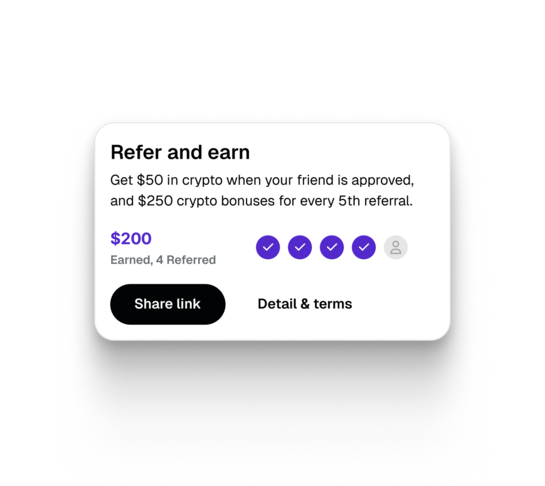

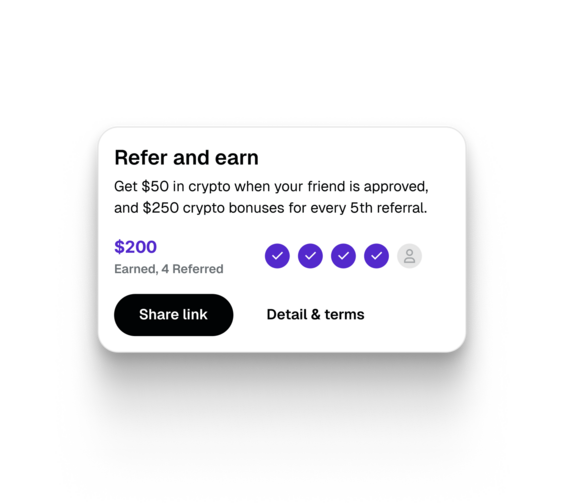

Refer friends, earn up to $5,000 in crypto.

Get $50 in crypto for each referral and an extra $250 bonus each time you make 5 referrals. Up to 50 referrals per year.4

Welcome to the future.

Invest as you spend.

Take Full Control of Your Finances

Seamlessly integrate the card with popular budgeting apps

Earn 10% Back on the Internet’s Favorite Brands.3

Refer friends, earn up to $5,000 in crypto.

Get $50 in crypto for each referral and an extra $250 bonus each time you make 5 referrals. Up to 50 referrals per year.4

Welcome to the future.

Invest as you spend.

Take Full Control of Your Finances

Seamlessly integrate the card with popular budgeting apps

Earn 10% Back on the Internet’s Favorite Brands.3

Refer friends, earn up

to $5,000 in crypto.

Get $50 in crypto for each referral and an extra $250 bonus each time you make 5 referrals.

Up to 50 referrals per year.4

Welcome to the future.

Invest as you spend.

The Gemini Credit Card is issued by WebBank.

- All qualifying purchases under the 4% back category earn 4% back on up to $300 in spend per month (then 1% thereafter in that month). Spend cycle will refresh on the 1st of each calendar month.

- Some exclusions apply to instant rewards in which rewards are deposited when the transaction posts. Subject to .

- 10% Vault Rewards are available on up to a limited value in spend per month and varies depending on the merchant offer. Subject to the .

- This offer is only available for the Credit Card Referral Program and .

Visit our for more information and additional FAQs.