Gemini Perpetuals

Gemini Perpetuals

Gain exposure to crypto with perpetual contracts.

Gemini Perpetuals is available in select jurisdictions globally. All Payment Token or Crypto Derivatives products or offerings are provided by Gemini Artemis Pte. Ltd. Please click Important Notice for more information.

Gemini Perpetuals by the numbers

Current Gemini perpetuals spreads, trading volumes, and more.

New Perpetual Contracts just added

Go long or short instantly with cross-collateral and deep liquidity for advanced traders.

Go long or short instantly with cross-collateral and deep liquidity for advanced traders.

Elevate your trading strategy

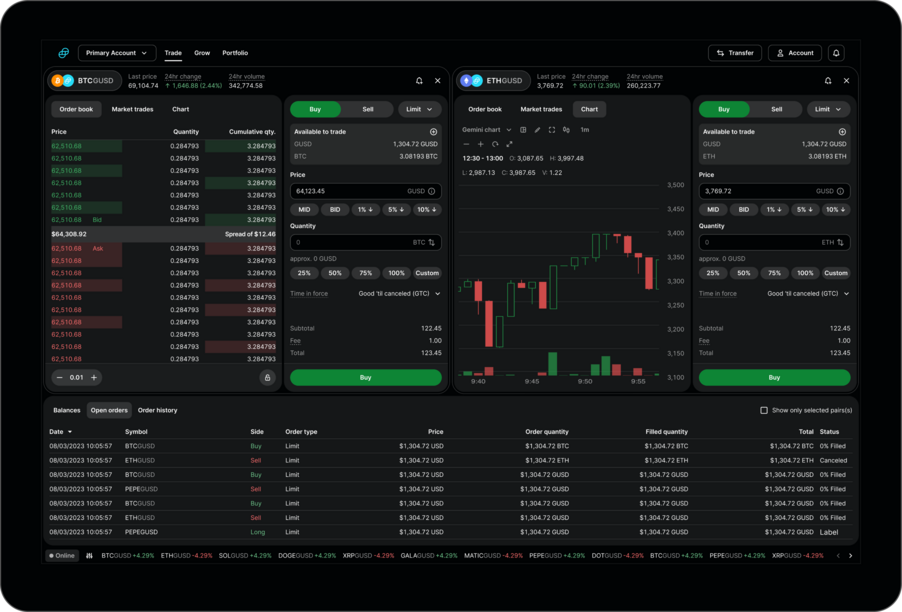

Gain directional exposure by trading perpetuals with no expiry and utilize cross collateralization for more flexibility and maximum capital efficiency.

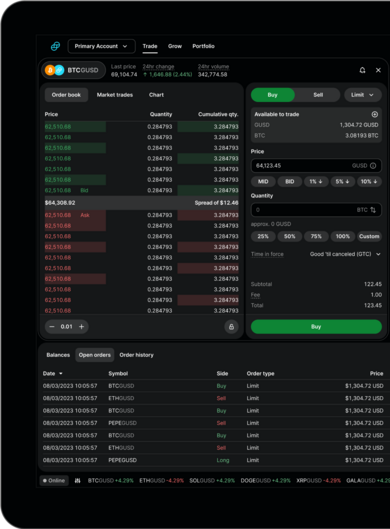

Execute trades in microseconds using our trading pair selectors and deep order book visibility to make the most of market opportunities.

Manage risk with confidence

Safeguard your investments in our ecosystem, navigating uncertainty effectively.

Up to

100x

leverage

Up to

100x

leverage

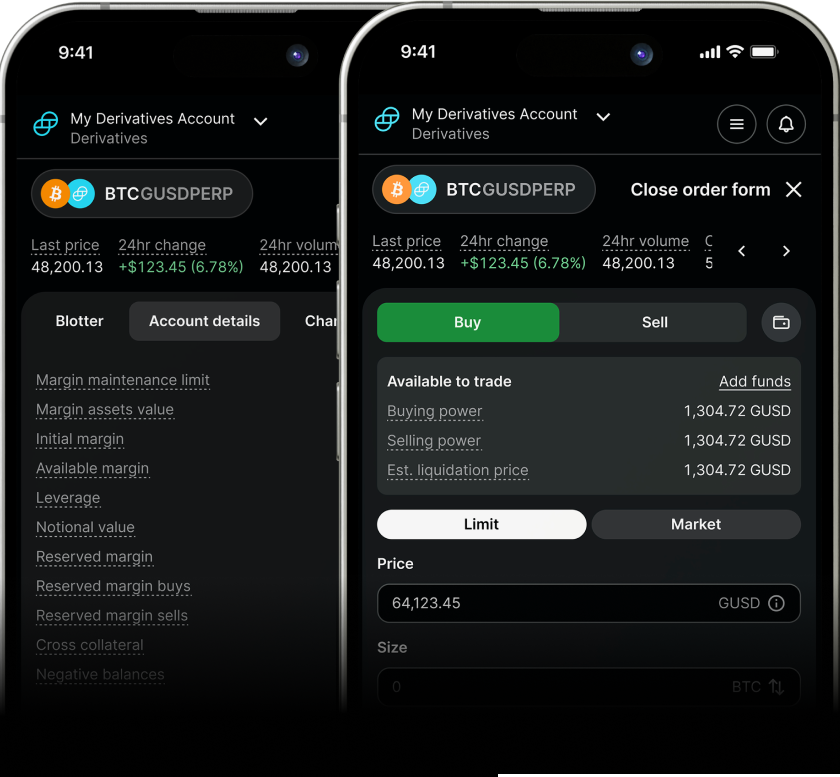

Capitalize on market opportunities and generate returns by trading on margin with up to 100x leverage.

Crypto Perpetuals 101

Crypto Perpetuals 101

No expiry date

A perpetual contract is similar to a crypto futures contract with one key difference - there is no expiry date. Traders can hold a position open as long as their margin is sufficient to avoid liquidation.

Custody-free exposure

Perpetuals derive their value from the underlying asset, meaning traders can gain exposure to a cryptoasset without having to hold it.

Trade long or short

Traders can long or short perpetual contracts, allowing them to benefit from prices moving both directions.

Cross collateral

With cross collateral, you can use a variety of assets such as USDC and BTC to support leveraged positions for your perpetuals trades.

Resources

The trusted crypto-native finance platform