OCT 18, 2018

Stablecoins: Understanding Counterparty Risk

A new kind of digital asset — a stable value coin — often referred to as a “,” has been proliferating in the cryptocurrency markets. Briefly, a stablecoin is a cryptocurrency pegged to a stable asset, such as fiat currency like U.S. dollars. Stablecoins are distinct from other cryptocurrencies like bitcoin, where the price is driven by market dynamics (i.e., supply and demand) and not from the asset which it corresponds to.

More information on understanding the counterparty risks of stablecoins can be found , but please find a summarized version below.

The volatility of bitcoin, ether, and other cryptocurrencies, makes it difficult to use them as an everyday medium of exchange, whether you are a crypto-trader looking to arbitrage markets or a consumer looking to purchase a pizza. Despite the benefits, however, stablecoins have unique risks that are important for the market and their users to understand; namely counterparty risks.

To date, the market and the media have been primarily focused on one element of counterparty risk — whether there actually is one U.S. dollar sitting in the issuer’s bank account for each stablecoin in circulation (i.e., a 1:1 peg). Many stablecoin issuers have failed to demonstrate that they can honor full 1:1 redemptions. We’ve touched upon the 1:1 peg and the associated regulatory oversight necessary to address this risk in a prior , but there are other elements of counterparty risk that have been almost entirely ignored (or perhaps forgotten) by the market and the media — the counterparty risk of the bank holding the U.S. dollars and the counterparty risk of the stablecoin issuer.

So why does this matter? Imagine if you had a bank account, but you didn’t know where it was located. Are your dollars held onshore, offshore, in a state bank, federal bank, etc.? Knowing your counterparty (i.e., the bank) is instrumental in assessing the risk profile of a stablecoin. Unfortunately, most stablecoin issuers have not provided transparency and visibility into the banks and financial institutions holding the corresponding U.S. dollars.

Additionally, it is important to understand if the stablecoin issuer has required licenses, both on a federal and state level, to issue a stablecoin. If not, it could be subject to regulatory enforcement and injunctive actions, indefinitely freezing your funds. Furthermore, if it is conducting unlicensed activity, it could lose its banking relationship and the bank account where your dollars are sitting.

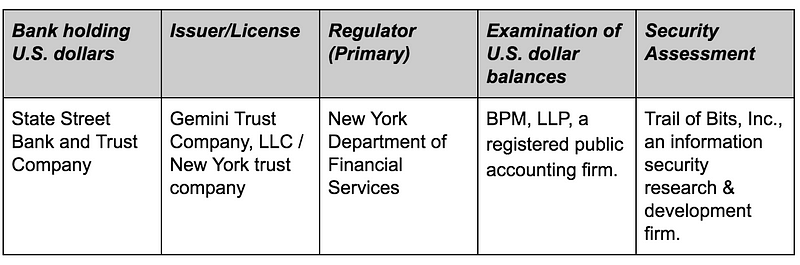

These layers of counterparty risk are important to understand as you peel back the stablecoin onion. We believe the transparency of the allows users to properly underwrite and assess counterparty risk of both the bank and the issuer, as well as others:

We believe regulation, transparency (attestation reports , security assessment report , and other appropriate disclosures are crucial to mitigating counterparty risk and protecting stablecoin users. Unfortunately, many stablecoin issuers lack the appropriate licensing and fail to provide adequate transparency for users to appropriately assess risk. A digitized currency with a stable value on the blockchain is a huge step forward for the future of money, but it requires the appropriate counterparties and oversight to ensure its true stability.

For questions or other inquiries, please contact us at .

Onward and Upward,

Team Gemini

RELATED ARTICLES

COMPANY

MAR 06, 2026

Sui Is Now Available On Gemini

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026

Gemini Staking Is Now Available for New York Customers

MORE FROM TEAM GEMINI

COMPANY

MAR 06, 2026

Sui Is Now Available On Gemini

WEEKLY MARKET UPDATE

FEB 12, 2026

US Jobs Report Beats Expectations, BlackRock Launches Tokenized Treasury Fund On Uniswap, and Crypto Lobby Meets To Solve CLARITY Act Impasse

COMPANY

FEB 10, 2026