Page d'accueil du blog

INDUSTRY

JUL 11, 2019

VCA Working Towards SRO Designation, Stands up Six Committees to Help Protect America’s Crypto Investors

Last August, Gemini announced its participation in the Virtual Commodities Association (VCA). We joined the VCA because in order to build the future of money, thoughtful regulation is necessary to create healthy markets.

The VCA’s goal is to establish itself as an industry-sponsored, self-regulatory organization (SRO) for the U.S. virtual currency industry, specifically virtual commodity marketplaces. This designation will allow the VCA to operate similarly to SROs in other industries, most notably the traditional financial industry, where the Financial Industry Regulatory Authority (FINRA) and National Futures Association (NFA) have self-regulatory authority over financial institutions.

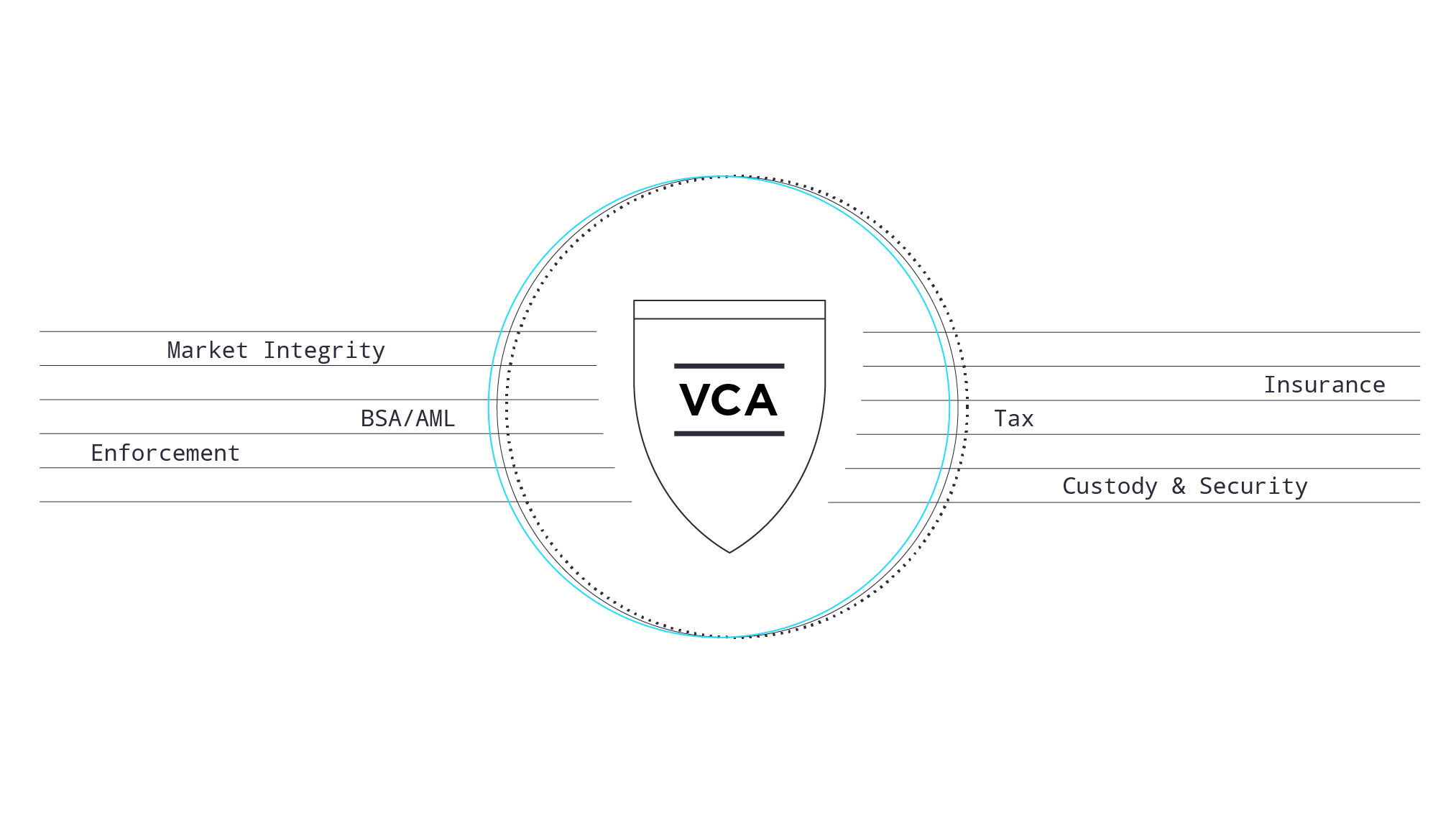

One of the first steps in this process is to create a framework which will eventually form sensible regulation for virtual commodity marketplaces. To do so, the VCA has launched six key committees that will help set standards, sound practices, and oversight.

The VCA will also be governed by a Board of Directors. I have been appointed President of the Board and Hailey Lennon, Esq., Head of Legal and Regulatory Affairs at bitFlyer USA, Inc. has been appointed Secretary of the Board. Special Advisors, which will oversee all committees, are Ellen Zimiles and Alma Angotti (Navigant Consulting, Inc.) and Dana Syracuse (Perkins Coie, LLP).

Several regulatory agencies have called upon the cryptocurrency industry to provide better oversight and surveillance of cryptocurrency markets. Through these committees, which will be led by financial and crypto industry subject matter experts, the VCA will adopt best practices and standards commonplace in traditional financial markets for cryptocurrency exchanges and custodians.

The six committees and leads include:

BSA/AML — led by Michael Carter (Alvarez & Marsal) to apply Bank Secrecy Act BSA/Anti-Money Laundering (AML) and Know Your Customer (KYC) controls, including blockchain analytics, transaction monitoring and investigations.

Custody and Security — co-led by Adam Cohen (Redgrave LLP) and Nicole Becher with a focus on implementing and maintaining current best practices for cryptocurrency custody, which is based heavily on cryptographic principles.

Enforcement — led by Philip Moustakis (Seward & Kissel, LLP) to enforce the regulatory framework established by the VCA, keeping the VCA members accountable. This includes maintaining a system of marketplace conduct rules, implementing policies and procedures, and responding to and addressing customer concerns and complaints.

Insurance — co-led by Matthew Gaul (Mayer Brown, LLP) and Alexander Sand (Eversheds Sutherland US, LLP) to establish minimum, appropriate insurances and coverages for cryptocurrency exchanges and custodians.

Market Integrity — led by Michael Roe (Exiger), to facilitate cross-market information sharing, consolidated audit trails and cross-market surveillance to detect and deter manipulative and fraudulent activity.

**Tax **— leader announcement forthcoming, will focus on establishing tax framework and interpreting and establishing tax code law as it relates to cryptocurrency trading.

We still have a long way to go but I am happy with where we are headed. The VCA is grateful to the individuals and companies willing to commit their time towards these committees and advance the goals of the VCA in fostering consumer protection and market integrity for the virtual currency industry.

I’m personally grateful to work for a company that takes matters like security, regulation, and consumer protections so seriously. To learn more about the VCA, please visit: https://virtualcommodities.org/.

Onward and Upward,

Yusuf Hussain, Head of Risk

ARTICLES CONNEXES

WEEKLY MARKET UPDATE

MAR 13, 2025

Recession Fears Weigh Down Crypto Market, Mt. Gox Moves ~$1B, and El Salvador Builds Up Bitcoin Reserve

COMPANY

MAR 12, 2025

Gemini To Set Guinness World Record With Largest Bitcoin Drone Show

COMPANY

MAR 12, 2025

USD Rails Launching for UK and EU Institutions

PLUS DE YUSUF HUSSAIN

Tout afficher

INDUSTRY

JAN 19, 2021

Gemini Completes SOC 1 Type 2 and SOC 2 Type 2 Examinations — Leading Crypto Industry

INDUSTRY

APR 21, 2020

Gemini Custody and Exchange Completes SOC 1 Type 1 Examination — Another First in Crypto!

INDUSTRY

JAN 23, 2020