Institutions

Why Institutions choose Gemini

Comprehensive products and services

✓ Competitive Spot and Derivatives trading fees ✓ State of the art Custody and Staking services ✓ Industry-leading platform integration with scalable APIs.

Comprehensive products and services

✓ Competitive Spot and Derivatives trading fees ✓ State of the art Custody and Staking services ✓ Industry-leading platform integration with scalable APIs.

Comprehensive products and services

✓ Competitive Spot and Derivatives trading fees ✓ State of the art Custody and Staking services ✓ Industry-leading platform integration with scalable APIs.

Fast application and onboarding

✓ Complete your application in 20 minutes or less*. ✓ 24/7 customer support worldwide to address your questions. ✓ Expedited onboarding process.

Fast application and onboarding

✓ Complete your application in 20 minutes or less*. ✓ 24/7 customer support worldwide to address your questions. ✓ Expedited onboarding process.

Fast application and onboarding

✓ Complete your application in 20 minutes or less*. ✓ 24/7 customer support worldwide to address your questions. ✓ Expedited onboarding process.

Solutions for all institutions

You are in good company

Products for institutions

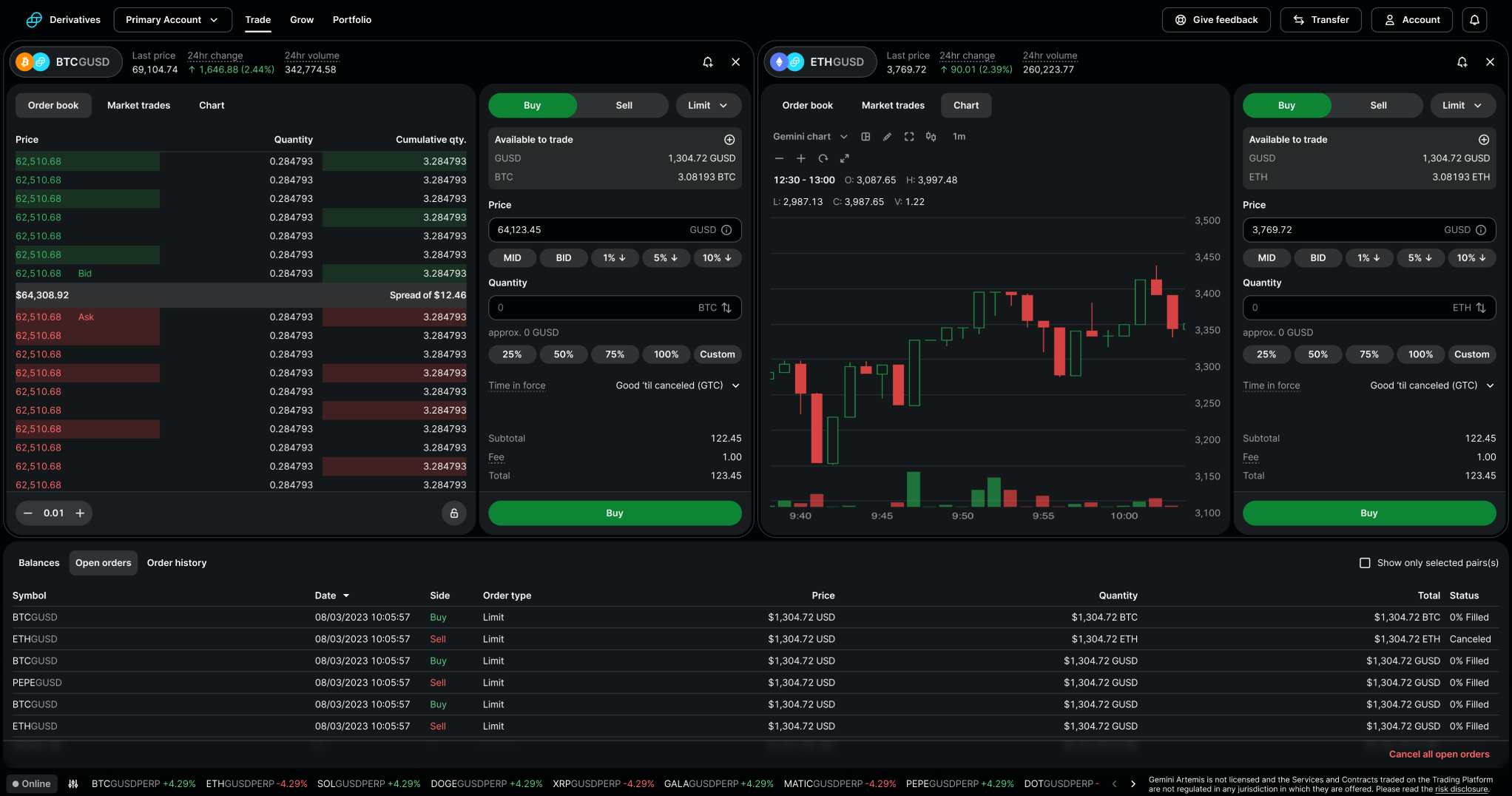

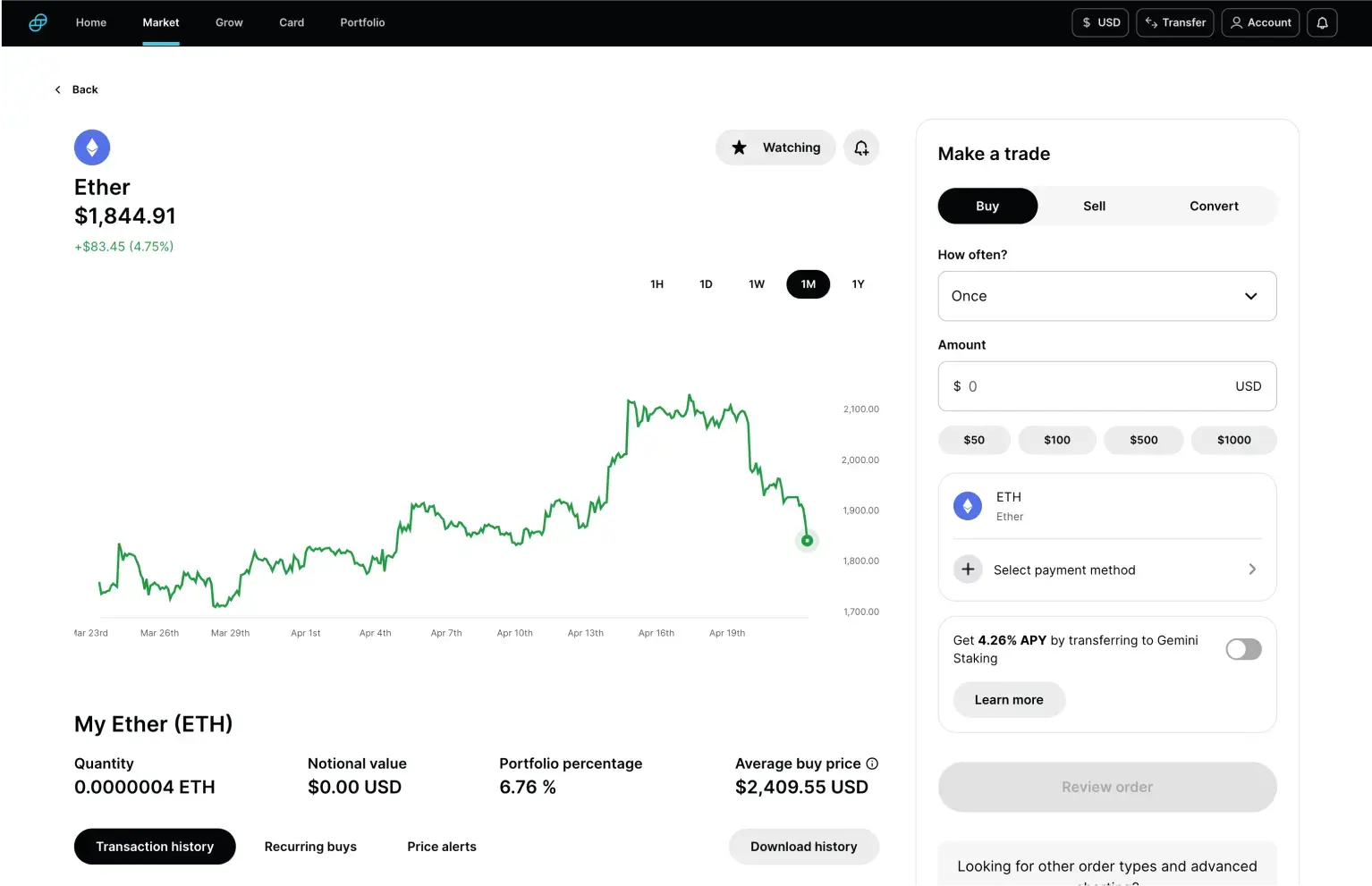

Gemini Spot and Derivatives Trading

Trade with confidence with advanced features for institutions on Gemini’s crypto-native platform

Gemini Spot and Derivatives Trading

Trade with confidence with advanced features for institutions on Gemini’s crypto-native platform

Features

ActiveTrader gives you all the tools you need to make informed trading decisions including real-time market data, advanced charting, cross collateral, and multiple order types.

Robust account management tools allow you to segregate your client’s portfolios or assign accounts to different managers or traders.

Integrate your trading systems to access order placement and real-time market data with our easy to implement exchange REST/FIX APIs.

Gemini Staking

Receive staking rewards by participating in the blockchain ecosystem with your crypto, all on a secure and regulated platform.

Gemini Staking

Receive staking rewards by participating in the blockchain ecosystem with your crypto, all on a secure and regulated platform.

Features

Institutions of any size can benefit from simplified access to the decentralized world of staking.

Gemini Staking offers competitive rewards and allows you to start staking with any amount of crypto.

With Staking Pro, get exclusive rewards, on-chain data access, and secure segregated rewards storage.

Gemini Custody

Safeguard your digital assets with secure and regulated cold storage.

Features

Your assets are safe in offline storage systems that use multisignature technology, role-based governance protocols, and multiple layers of biometric access controls and physical security.

With the Gemini Instant Trade™ feature, you can trade directly on Gemini Exchange with assets held in offline (“cold”) storage.

Customized pricing aligned to the needs of your business. Gemini works with each customer to create tailored, unique price plans.

Gemini eOTC

Trade with deep liquidity for optimal price execution of large crypto orders.

Features

Orders are executed using the best price sources from top liquidity providers to pass on the tight spreads and deep liquidity to you.

Track multiple trade opportunities at once and execute with a single click, or use our APIs.

Maximize your capital’s efficiency and trading flexibility with delayed net settlement and intraday trading credit.

Want to learn more about our crypto solutions for institutions?

*The total time spent may vary, depending on individual factors such as information available to you at the moment of completing the application, and does not include the time it may take for approval

Institutional Insights

Recent institutional stories and insights from our blog

Questions? Answers

My business is based outside the U.S. Can I open a Gemini institutional account?

We operate in more than 60 countries globally. Please check our Areas of Availability page for all countries of availability.

I’m with a larger firm and need guidance. How can I speak with a Gemini team member?

Click on the “Connect with our team” link at the top of this page and send us a message. Our team will reach out to assist you.

Do I need to finish my entire application in one sitting?

No. Once you create your administrative user (step 1), you are free to stop and come back whenever you want.

What documents will I need to provide?

The required documents will change depending on the entity type. However, a W9/W8, a bank statement, and IDs of all relevant individuals is required for all entity types. Our improved application will guide you through the process.

How long does the account application process take?

The application process typically takes 20 minutes or less to complete. After submission, our team will review your application and reach out once the review is completed or if they require any additional information.

What are the steps for submitting an institutional application?

First you will create your administrative user account. There will be several screens asking for information including company details, documents like a W9/W8 and a bank statement, and key account managers. Our application portal will guide you through the process. When you submit this information, it then gets passed to our compliance team for review. We’ll be in touch within one to two business days! Please note, Gemini is required by law to collect this information to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.